The Shift Beneath the Surface

Middle East Flashpoint Reveals Systemic Fragility. A surprise military escalation between Israel and Iran this month – including Israeli strikes on Iranian nuclear sites and Iran’s retaliation against U.S. forces – briefly sent oil prices surging to five-month highs, before a shaky ceasefire pulled them back down. Superficially, it’s a familiar geopolitical crisis. But through the planetary phase shift lens, it exposes a deeper pattern: a dying fossil-fueled order lashing out amidst its own contradictions. The conflict’s roots intertwine decades of resource competition, security dilemmas, and climate-stressed instability – systemic pressures mounting in the last stage of the global industrial lifecycle. The scramble to secure oil supply (the U.S. openly feared closure of the Hormuz chokepoint that carries ~20% of world crude) underscores how dangerously tethered global stability remains to fossil fuels. Current risks are stark: miscalculation could have spiraled into regional war and oil shock, compounding a polycrisis of conflict, inflation, and energy insecurity. Yet emerging alternatives glimmer. The crisis has accelerated talk of energy transition as true energy security – evidenced by calls to cut dependence on Middle East oil. It also showcased novel de-escalation: Iran’s restrained response (avoiding oil transport targets) helped defuse panic, hinting that even adversaries recognize the unsustainability of uncontrolled escalation in a tightly coupled world.

Investor insight: The oil price whiplash (up 6%, then down 13% in days) is a reminder that fossil investments face not just climate risk but severe geopolitical volatility.

Citizen implications: This week’s headline is a sobering call – our fossil-fueled global system is brittle. Accelerating the shift to renewables and diplomacy isn’t just idealism; it’s the practical path to reduce the war and chaos that threaten everyday security.

HUMAN SYSTEM

Signals from the Engine Room (Material Systems in Flux)

Energy – Fossil Foundations Cracking, Clean Tech Scaling Up

What’s breaking down? The dominance of fossil fuels is entering terminal decline. Global investment in oil and gas is finally falling – upstream oil spending will drop an estimated 6% in 2025, the first such cut since the 2020 pandemic shock. This pullback comes as lower demand expectations and climate policies bite. Coal, too, is being rapidly outpaced; in March, for example, fossil fuels generated <50% of U.S. electricity for the first time on record. Even OPEC acknowledges a peak in oil demand is looming sooner than previously thought. These are clear signs of an energy regime in its endgame. Yet the decline is not smooth: the Israel-Iran oil scare showed how geopolitical “risk premiums” still haunt oil markets, reminding us that our legacy energy system grows ever more volatile as it unravels. Aging refineries, grid failures under extreme weather, and stubbornly high fossil fuel prices earlier in the year (contributing to cost of living crises) all underscore a system straining under its own weight.

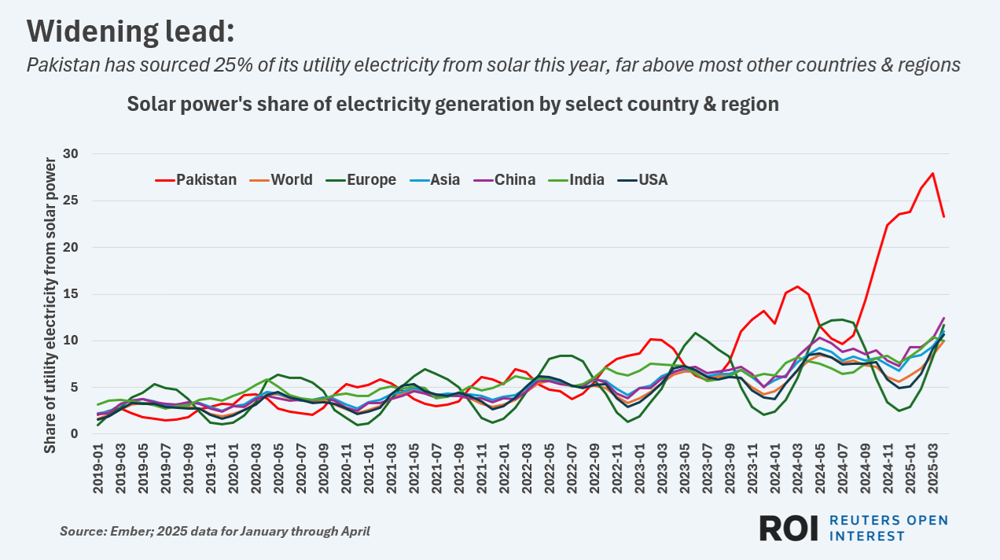

What’s scaling up? A clean energy revolution at unprecedented scale. The International Energy Agency projects $2.2 trillion will be invested in clean energy in 2025, double the amount still flowing into fossil fuels. Solar power leads the charge – expected to attract a record $450 billion in investment this year – and new data show it’s paying off. China just hit a 26% wind and solar share of its electricity in April, tripling those sources’ share since 2020. Worldwide, renewables are set to overtake coal in electricity generation in the next year. From Pakistan to California, milestones abound: Pakistan sourced 25% of its power from solar in early 2025 (leapfrogging from near-zero in a few years), and California briefly hit 100% renewable power on multiple days. Meanwhile, battery storage investments (~$66B in 2025) are surging 50%+ annually, hydrogen projects are in the pipeline, and next-gen nuclear and geothermal pilots are attracting fresh capital. The pieces for a reliable post-carbon grid are finally falling into place.

Why this matters now: This week crystallizes a critical inflection point. Fossil fuel markets are increasingly precarious – subject to war and weather disruptions – just as clean energy proves it can shoulder the load. Record heatwaves and floods (powered by fossil-fueled warming) hammer home the cost of delay, while record renewable rollouts show a viable escape route. Energy is the engine of the “material” economy; its shift from a high-carbon to a low-carbon basis is perhaps the most pivotal transition of the planetary phase shift. The faster we complete it, the more we blunt climate risk and reduce the kind of security crises witnessed this month.

Investor insight: The smart money is rotating out of oil and gas – whose prospects dim between demand peak and carbon regulation – into renewables, storage, grids, and clean mobility. Clean energy stocks and green bonds stand to gain from enormous policy tailwinds (e.g. the US IRA, EU Green Deal) and public support. Fossil-heavy assets, by contrast, face stranded asset risk and geopolitical instability.

Citizen implications: A renewable energy future promises not just a cooler planet, but improved energy access and affordability. Every solar panel on a school or wind farm in a community means more local jobs and less vulnerability to distant turmoil. In the near term, however, households should brace for continued price swings at the gas pump or heating bill until the clean transition fully stabilizes energy costs. Pushing local leaders to adopt solar, storage and efficiency measures can help shield communities sooner.

Like what you see? Get access to Bulletins like this every single week by joining Premium!

Already have an account? Log In

Mobility – End of the Oil Car Era Accelerates

What’s breaking down? The century-long reign of the internal combustion engine (ICE) vehicle is sputtering. Traditional automakers are facing an existential crossroads: those slow to electrify are seeing sales stagnate and reputations falter. In Europe, overall car sales are flat (-0.6% YTD) despite economic recovery, largely because consumers are holding out for electric options. The CEO of Toyota (long a hybrid/ICE champion) recently admitted “the ship has sailed” on the EV shift, a stark reversal. We’re also seeing the policy screws tighten on gasoline cars – more cities announcing future combustion car bans and stricter emissions rules on the horizon (even as the U.S. under Trump signals rollbacks, many states and other countries forge ahead regardless). The oil demand for road transport is nearing a peak as a result. Meanwhile, the automobile culture itself is under pressure: urban air pollution and climate concerns are making car-centric planning less tenable. This week, Nissan’s management came under fire from shareholders for lackluster performance – a proxy for its slow EV transition. The writing on the wall: adapt or perish. Assembly lines for ICE components are already idling or retooling, and some suppliers tied to engines and transmissions face bankruptcy absent new strategy.

What’s scaling up? Electric vehicles (EVs) and new mobility models are hitting escape velocity. Over 1.6 million EVs (battery and plug-in hybrids) sold worldwide in May alone – a 24% jump from last year – as EVs race toward an expected 25% of global new car sales in 2025. China continues to dominate, surpassing 1 million EVs in a single month for the first time in May (driven by BYD and others both meeting roaring domestic demand and exporting to emerging markets). Europe is also accelerating: EV sales up 36% year-on-year, buoyed by new incentives in places like Germany. Innovation isn’t limited to personal cars – we’re seeing rapid growth in electric buses, commercial fleets, and micro-mobility (e-bikes, scooters) transforming city transit. Notably, Tesla began testing a robotaxi service in Austin, Texas, using its autonomous EVs. And just this week, a major US airline announced a purchase of electric vertical takeoff aircraft (eVTOLs) for short-hop routes, betting on battery flight. These developments point to a rapidly emerging new mobility ecosystem: ride-sharing, automation, and electrification converging. The upshot is that the global oil demand curve for transport is flattening, and tailpipe emissions in many countries have peaked.

Why this matters now: The transportation sector is the #1 source of U.S. emissions and a major source globally; its swift electrification is indispensable for climate goals. The signals this week – from market data to shareholder revolts – indicate the transition is not only underway, but accelerating faster than many anticipated. Each EV on the road means reduced local air pollution (as residents of smoggy cities like Delhi and Los Angeles desperately seek) and less climate-heating CO₂. But there are short-term challenges: charging infrastructure rollout needs to keep pace (in many regions it’s lagging EV sales), and supply chains for critical minerals like lithium and nickel must scale sustainably to avoid bottlenecks.

Investor insight: The auto industry disruption is creating clear winners and losers. EV-focused automakers and suppliers (battery makers, charging network operators, semiconductor firms) are gaining valuation, while legacy automakers that haven’t convinced markets of their EV strategy are being punished. There’s also opportunity in commodities (e.g. lithium, though subject to boom-bust) and recycling of EV batteries – a burgeoning circular economy play. On the flip side, oil companies face a structural decline in their largest demand segment; some are diversifying into charging networks and renewables, but others risk steep decline if they cling to a shrinking market.

Citizen implications: For consumers, the shift means expanding choices of cleaner, quieter vehicles and, importantly, a chance for cities to reclaim space from traffic and pollution – think more bike lanes, pedestrian zones, and transit-oriented development as car dominance wanes. In the near term, governments will need to manage a fair transition: ensuring EVs become affordable to all (incentives, used EV markets) and helping workers in ICE-centric industries retrain for the electric future. The good news: fueling an EV already costs far less per mile than filling a gasoline car, and that gap will grow, translating to big savings for families and businesses alike once upfront costs drop.

Materials – Linear Economy Under Strain, Circular Solutions Emerging

What’s breaking down? The traditional “take-make-waste” materials economy is running up against hard limits. This week highlighted how resource nationalism and supply chain fragility are undermining old material flows. In London trade talks, the US and China remained at an impasse over critical rare earth magnets – China is withholding exports of certain rare earth materials vital for U.S. fighter jets and missiles, effectively weaponizing control of raw materials in response to U.S. tech sanctions. This standoff underscores the vulnerability of high-tech and defense supply chains that rely on geographically concentrated minerals. At the same time, Europe’s steelmakers sounded alarms that the global scrap metal market is being distorted: with President Trump’s tariffs and buy-American policies, European firms are calling to curb scrap exports to keep recycled steel feedstock at home. It’s an ironic twist – scrap, the epitome of circular reuse, is now a strategic asset. More broadly, commodities from copper to lithium remain volatile, and mining projects face increasing social resistance over environmental damage. The “externalize costs” model of material extraction is being challenged by communities and courts worldwide. Whether it’s deforestation for minerals or overflowing landfills, the linear model’s social license is eroding.

What’s scaling up? A circular, sustainable materials paradigm is gaining traction. Major industries are investing in reuse, recycling, and low-carbon alternatives to steel, cement, plastics and more. This week, a few notable moves: Microsoft signed a deal to purchase 600,000+ tons of carbon-neutral cement for construction projects – catalyzing demand for cleaner concrete in an otherwise heavy-polluting sector. Automakers Volvo and JLR took steps to “close the loop” in manufacturing, with Volvo securing recycled steel for its next EV models and JLR hiring specialists to bolster ethical sourcing and traceability in its supply chain. These are concrete examples of circular economy principles (using recycled inputs, extending material life, ensuring fair supply chains) becoming mainstream. On the policy side, momentum is growing for extended producer responsibility laws and “right to repair” regulations, particularly for electronics – meaning companies must design products for longevity and recyclability. And innovation continues: researchers announced progress in substituting rare earths in magnets, and startups are scaling tech to urban-mine e-waste for valuable metals. Even the global treaty on plastic pollution is inching forward, aiming to slash single-use plastics and foster reuse systems.

Why this matters now: Material systems form the physical backbone of civilization – from buildings and phones to food packaging. How we source and dispose of those materials is pivotal for sustainability. The current flashpoints (rare earths, scrap steel) show that business as usual is brittle, prone to conflict and shortages. Moving to a circular model isn’t just an environmental nicety; it’s about resilience and self-reliance. Recycling steel and aluminum uses a small fraction of the energy of primary production, and every ton reused cuts emissions and avoids mining waste. The breakthroughs we see – corporate procurement of green materials, national strategies for critical minerals, etc. – indicate a transition in motion. However, scaling will require coordinated effort: better recycling infrastructure, new skills for workers (like in sorting and remanufacturing), and overcoming initial cost barriers for novel materials.

Investor insight: Companies that embrace circular principles could gain a competitive edge amid volatile raw material prices. Sectors like construction and fashion are ripe for disruption by low-waste innovators (think modular building components, or resale/upcycling platforms). Conversely, firms that ignore sustainability may face supply disruptions and brand damage. There’s also a regulatory risk: the EU and others are planning carbon border tariffs and recyclability mandates – late adopters could be priced out.

Citizen implications: A shift to circular materials will impact daily life in subtle ways: products lasting longer, more options to repair devices, deposit-return schemes for packaging, and perhaps fewer temptations of ultra-cheap disposable goods. In return, communities benefit from less pollution (fewer toxic mine tailings, less plastic in oceans) and local job creation in recycling and repair industries. The bottom line: the more we treat materials as valuable assets to continually recirculate, the more we buffer ourselves against both ecological and geopolitical shocks.

Like what you see? Get access to Bulletins like this every single week by joining Premium!

Already have an account? Log In

Food – Industrial Food System Fractures, Regenerative Foodscape Sprouting

What’s breaking down? The global food system’s fragility is on full display, with climate extremes and conflict driving acute food insecurity. A joint UN early warning report issued this week starkly warned that 13 countries are poised for a serious deterioration in acute hunger in coming months, with 5 hotspots (Sudan, South Sudan, Haiti, Mali, and Palestine) at risk of outright famine. Conflict remains a primary driver – as seen in Sudan’s civil strife and Haiti’s instability – but climate shocks are compounding the crises. In the Horn of Africa, below-average rains forecasted after multiple failed seasons could push Somalia into famine conditions, affecting over a million more people. Alarmingly, global hunger levels today are barely improved from 30 years ago, even as billionaire wealth soars – a sign of systemic failure in equity and resilience. On the production side, we saw how extreme weather threatens food supply: China’s floods jeopardize rice and cotton crops, and the U.S. heatwave wilted corn in the field. Food prices have been creeping up again, with staples like wheat and sugar affected by unpredictable yields and export restrictions. Meanwhile, industrial agriculture’s environmental toll (soil degradation, fertilizer runoff dead zones, high emissions) continues to mount, undermining the very ecological foundations of food production. The “engine room” of food – the complex global supply chains and monocultures – is thus sputtering under stress.

What’s scaling up? A different approach to food is emerging, centered on sustainability, diversity, and resilience. Regenerative agriculture – farming practices that restore soil health and sequester carbon – is gaining converts, from major food companies investing in pilot projects to governments incentivizing cover crops and agroforestry. This week, for instance, the EU moved forward on its sustainable food strategy, and Vietnam reported training 2.2 million farmers in climate-smart agriculture practices to boost yields and cut emissions. Urban agriculture is also blossoming: city rooftops and vertical farms are supplying local produce in an expanding number of cities, reducing dependence on far-flung supply chains. And in a high-tech twist, cultivated (lab-grown) meat just notched another approval – Australia’s food regulator approved cell-cultured quail meat for sale, joining a handful of countries embracing this novel protein. The prospect of growing meat without raising animals could dramatically cut land and water use (and ethical concerns) if it scales. Beyond production, there’s momentum on reducing food waste – apps and community initiatives are connecting surplus food with those in need, while several U.S. states this week advanced laws restricting organic waste in landfills. Even consumer behavior is nudging toward change: plant-based diets and “climavore” eating (choosing foods with lower climate impacts) continue to rise, especially among younger generations.

Why this matters now: Food is fundamentally a system of energy, water, land, and life – and it’s where human and Earth systems directly meet. When food systems break, we see conflict and migration (as hunger drives desperation), and when they heal, we see societal flourishing. The juxtaposition this week of famine warnings and forward-thinking farming initiatives encapsulates the crossroads we face.

Investor insight: Food and agriculture are ripe for impact investment and innovation. There are opportunities in agri-tech (drought-resistant seed genetics, precision irrigation), alt-proteins (plant-based and lab-grown meat startups attracted hundreds of millions in capital), and supply chain localization (cold storage, food logistics in emerging markets). Conversely, conventional agribusiness faces rising risks – from volatile commodity prices to the reputational and legal risks around deforestation and methane emissions. Watch for carbon credit markets expanding into soil carbon sequestration, potentially rewarding farmers who adopt regenerative methods.

Citizen implications: Expect to see changes in what and how we eat. Climate change is already affecting the availability and price of certain foods (coffee, chocolate, staple grains), which might spur shifts toward more resilient crops and more plant-centric diets. On the positive side, healthier, local, and sustainable food options are likely to become more common – from farmers’ markets to meat alternatives at your local grocery. Supporting these trends (e.g. joining a community-supported agriculture program or choosing regenerative-certified products) can help build a food system that is buffered against shocks and better for both people and planet.

Information – Disinformation Crisis and the Rise of Community Knowledge

What’s breaking down? The integrity of our information environment is under unprecedented strain. Trust in traditional news media has plummeted to around 40% globally, down from ~60% a few years ago. This week, the Reuters Institute’s Digital News Report 2025 highlighted a continuing free-fall in engagement with TV news, print, even mainstream news sites. In parallel, the vacuum is being filled by a deluge of misinformation and partisan content on social platforms. Political leaders are increasingly bypassing the press to speak through friendly podcasters and YouTubers – as seen in the U.S. where major presidential candidates snubbed mainstream interviews for influencer chats. While this allows unfiltered messaging, it often escapes critical scrutiny, enabling narratives that can be misleading or polarizing. The advent of generative AI is a wildcard intensifying the breakdown: we’re seeing AI-generated fake images, videos, and entire news articles flooding the internet, making it ever harder for citizens to discern truth. And authoritarian governments are doubling down on information control – from Internet shutdowns during protests to draconian “fake news” laws used to jail journalists. In short, the old gatekeepers of factual information are eroding, and nothing stable has replaced them, leading to a kind of “information entropy.” For many, this manifests as news avoidance or confusion – a sense that staying informed is overwhelming or pointless. The social cohesion costs are evident: without shared facts, societies struggle to unite on any common cause, be it public health or climate action.

What’s blossoming? In response to the chaos, new forms of community-centered and transparency-focused information systems are emerging. Independent journalists and experts are flocking to newsletter platforms, podcasts, and social media communities to reach audiences directly – creating a burgeoning “creator economy” for news. Some of these creators (including scientists and educators on TikTok, Substack investigative reporters, etc.) are managing to engage younger audiences that legacy media lost. We’re also seeing the rise of collaborative fact-checking and open-source intelligence (OSINT) communities that debunk false claims in real time (for example, citizens on Reddit and Twitter debunking war disinformation using satellite imagery and geolocation). Importantly, institutions are beginning to intervene: the EU’s Digital Services Act took effect, forcing big tech platforms to disclose algorithms and moderate content more aggressively, which might over time reduce the virality of lies. UNESCO is pushing a global code of practice for platforms on misinformation. On the ground, local media co-ops and nonprofit newsrooms (often funded by community subscriptions or philanthropy) are filling news deserts with accountable reporting. Finally, niche platforms catering to certain values – like open-source social networks (Mastodon, Bluesky) or encrypted group chats – are gaining users fed up with ad-driven algorithmic feeds. These alternatives emphasize quality over quantity, privacy, and community norms as antidotes to Big Tech’s engagement-at-all-costs model.

Why this matters this week: A functioning “information immune system” is critical during a planetary phase shift, because navigating complex crises requires an informed public and accountable leadership. The signals we saw – plummeting trust, but also creative new models – reveal an information paradigm in transition.

Investor insight: While media companies may not seem an obvious investment for some, the shake-up is creating opportunities. Subscription-based niche media are showing viability (people will pay for trusted analysis in areas they care about). AI companies offering verification and media authentication services are poised to be in high demand (to identify deepfakes, etc.). On the flip side, social media giants that fail to address toxic content risk regulatory backlash and user attrition, which can impact their profitability (advertisers don’t want their brands next to misinformation).

Citizen implications: In the near term, we all have to navigate an information minefield – it’s wise to double-check sensational claims with credible sources, and digital literacy is more important than ever (schools are starting to teach how to spot AI fakes, for example). But the blossoming alternatives mean citizens can also participate in fixing the system: by supporting independent media through subscriptions or donations, joining local civic data projects, or contributing to community fact-checks. The future information landscape could be designed to become more decentralized and democratic, but this will require active engagement from citizens as creators and curators, not just passive consumers. The encouraging trend is that many, especially youth, are rising to that challenge – forging new channels to demand truth and transparency in an era awash in noise.

Like what you see? Get access to Bulletins like this every single week by joining Premium!

Already have an account? Log In

EARTH SYSTEM

Ecosystem Breakdowns: Alarms from a Overheated Planet

Heat Records Shattered in the U.S. A brutal heatwave blanketed the U.S. Northeast, with Washington D.C. and Boston hitting 101°F (38°C) – beating previous records by as much as 6°F. New York City nearly broke its peak June temperature at 99°F. Infrastructure strained as Amtrak slowed trains to prevent derailments and even the Washington Monument closed due to the extreme heat. Scientists were unequivocal: such record-shattering heat would be virtually impossible without climate change’s influence. The frequency of these “once-in-a-generation” hot days is up dramatically, signaling that ecosystems and urban systems are ill-prepared for the new normal of heat extremes.

Asia Drowned by Extreme Rains. On the other side of the world, central China grappled with catastrophic flooding. The government issued rare top-level red alerts across six provinces as torrential monsoon rains – arriving early and intensely – overwhelmed flood defenses. China’s meteorologists explicitly linked the severe rainfall to climate change. Flash floods submerged city streets up to power lines and displaced thousands. With China’s $2.8 trillion agricultural sector at risk from both floods now and expected heat/drought to follow, the event illustrates how climate instability is pushing natural and human systems past breaking points.

Reefs Bleaching on Unprecedented Scale. Hidden beneath the waves, the world’s coral reefs are in acute distress. Over the past two years, bleaching-level heat stress has impacted a record 83.7% of global reef area, the largest such event ever observed. Mass bleaching – corals expelling their symbiotic algae – has now been documented in at least 83 countries. This startling statistic, compiled by NOAA, indicates that even corals historically considered resilient are “succumbing to partial mortalities” in the face of rising ocean temperatures. Bleaching is the literal whitening of reefs – “as if a silent snowfall has descended,” in the words of one marine scientist. It’s an existential red flag for marine ecosystems and coastal communities alike.

Why these breakdowns matter: These concurrent alarms – on land and sea – underscore that Earth’s life-support systems are buckling under human pressures. Heatwaves and floods that once were rarities are now regular summer events due to our altered atmosphere. Ecosystems from forests to coral reefs are losing resilience. Each breakdown has compounding human costs: crop failures, infrastructure damage, displacement, and amplified inequality (those with the least resources are hit hardest). The distress signals of a destabilized Earth system are loud and clear this week.

Investor insight: Physical climate risks are no longer theoretical – they are disrupting supply chains, agriculture, and productivity in real time. Portfolios must price in extreme weather disruption across regions and sectors.

Citizen implications: From higher food prices to health dangers (heat stroke, water scarcity) and lost natural heritage (dying reefs), everyone’s daily life is or will be touched. The case for rapid climate action and ecosystem restoration has never been more urgent or more tangible.

Regenerative Breakthroughs: Seeds of Restoration and Renewal

Nationwide Reforestation in Ghana. In an inspiring counterpoint, Ghana has launched an ambitious “Tree for Life” restoration campaign to heal landscapes and fight climate change. The program, formally kicked off this week in Accra, aims to plant 30 million trees across all regions in 2025. It’s not just about tree-planting – it’s a holistic effort coupling reforestation with cleaning up polluted rivers (“Blue for Water” initiative) and curbing illegal mining that ravages ecosystems. The government is engaging youth crews to establish commercial forest plantations and supplying farmers with tree seedlings to interplant with cocoa crops. This bioregional policy, supported by diplomatic and private partners, shows a model of inclusive, job-creating regeneration. Ghana’s commitment exemplifies a new development mindset: environmental restoration as a foundation for economic resilience and community well-being.

Wildlife Comeback: Monarch Butterflies Rebound. Even as biodiversity crises abound, targeted conservation is yielding results. In North America, the iconic eastern monarch butterfly population nearly doubled in size over the last year. The latest joint survey by WWF and Mexican agencies found monarchs occupying 4.42 acres of forest in their Mexican overwintering grounds, up from 2.22 acres the previous winter. This is a hopeful uptick for a species that had plummeted well below historical averages. Experts credit improved habitat protection and favorable weather along the monarchs’ migration route for the resurgence. Notably, forest degradation in the Monarch Butterfly Biosphere Reserve’s core zone dropped 10% as illegal logging was curbed. While monarch numbers are still far from secure, this bounce-back illustrates how quickly nature can respond when given a breather. It’s a small yet significant victory for pollinators and the ecosystems they support.

Ocean Protection Milestone in the Pacific. In a landmark for marine regeneration, French Polynesia announced the creation of the world’s largest marine protected area (MPA) at the UN Ocean Conference this month. The plan will safeguard nearly 5 million square kilometers of the South Pacific – an area the size of the European Union – with 1.1 million km² designated as highly or fully protected (off-limits to extractive activities like deep-sea mining and industrial fishing). Local Polynesian communities strongly back the move, seeing it as “asserting ecological sovereignty” and preserving their life-giving ocean for future generations. By combining modern conservation with Indigenous stewardship practices (such as rahui temporary closures), this initiative exemplifies the emerging “nature-positive” paradigm. It will create vast safe havens for sharks, corals, tuna, and whales – a bold step toward the global 30x30 ocean protection goal.

Why these breakthroughs matter: Amid the gloom, these stories highlight humanity’s capacity to repair and reimagine. Ghana’s reforestation drive links climate action to economic development, modeling how Global South nations can lead on regenerative investment. The monarch rebound shows that species on the brink can recover if we address root causes (habitat and pesticide management). And the French Polynesia MPA – covering an entire exclusive economic zone – signals a new level of ambition in safeguarding the global commons. Each “small” win contributes to tipping points of recovery: regrowing forests that cool the air and bring rains, pollinators returning to farmers’ fields, fish spawning in no-take zones and replenishing seas.

Investor insight: Restoration and resilience projects are opening new markets – from reforestation carbon credits to eco-tourism and sustainable fisheries – while de-risking investments threatened by ecosystem collapse. Early movers backing nature-positive ventures (reforestation, reef insurance, regenerative agriculture) stand to benefit from policy support and growing public demand.

Citizen implications: These breakthroughs remind us that progress is possible. Supporting tree-planting drives, local conservation groups or sustainable products amplifies these efforts. More directly, healthier ecosystems mean more stable livelihoods – whether it’s cooling shade and fruits from Ghana’s trees, crop pollination by butterflies, or plentiful fish for Pacific islanders. In short, investing in nature’s recovery is an investment in community prosperity and climate stability.

Like what you see? Get access to Bulletins like this every single week by joining Premium!

Already have an account? Log In

Signals & Data

The following indicators capture this week’s phase shift signals across the Engine (material) and Control (institutional) rooms. They quantify the breakdown of legacy systems and the scaling of new ones:

|

Metric (Weekly/Current) |

Value |

Source |

|

Global Clean Energy Investment (2025) – Expected spending on renewables, nuclear & storage this year (2× fossil fuel investment) |

$2.2 trillion |

IEA World Energy Investment Report |

|

Upstream Oil & Gas Investment (2025) – Projected change in fossil fuel spending as demand outlook shifts |

-6% (decline from 2024) |

IEA analysis (first drop since 2020) |

|

Global EV Sales (May 2025) – Electric (battery + plug-in) vehicles sold, reflecting rapid adoption |

1.6 million (+24% YoY) |

Rho Motion / Reuters Market Data |

|

Heat Record – Washington, DC (June 24, 2025) – Temperature during Northeast US heatwave (highest on record, +6°F vs prior) |

101°F (38.3°C) |

National Weather Service / Reuters |

|

China Extreme Rainfall Alerts (June 20, 2025) – Provinces on top flood alert as monsoon rains hit early |

6 provinces (Red Alert) |

China Min. Water Resources via Xinhua |

|

Global Coral Bleaching (2023–25) – Coral reef area exposed to bleaching-level heat stress in ongoing event |

83.7% of reefs |

NOAA Coral Reef Watch / WEF |

|

Billionaire Wealth Increase (2024) – New wealth accrued by world’s billionaires last year (amid polycrisis) |

+$2 trillion |

Oxfam “Takers Not Makers” Report |

|

Global Wealth Inequality (2024) – Share of total wealth owned by richest 1% of people worldwide |

45% (wealth to top 1%) |

Oxfam / Davos Inequality Brief |

|

Youth Climate Anxiety (2024) – U.S. youth (16–25) who are “very” or “extremely” worried about climate change |

57.9% of youth |

Lancet Planetary Health Survey |

|

Gen Z Sustainability Preference (2025) – Global Gen Z consumers willing to pay more for sustainable products |

73% of Gen Z |

First Insight Consumer Report |

|

Rights-of-Nature Laws (2023) – Legal provisions globally that grant Nature enforceable rights/status |

500+ laws & policies |

Global Alliance for Rights of Nature |

Solar’s Surging Share. Pakistan’s solar boom exemplifies the clean transition: by early 2025, 25% of its utility electricity came from solar – far above most countries (red line). Global (blue) and major regions lag behind but trend upward. This widening lead shows what’s possible with rapid capacity growth. Source: Ember data (Jan–Apr 2025) via Reuters Open Insight.

STRATEGIC FORESIGHT

This week’s turbulence reveals a world teetering between breakdown and breakthrough. The convergence of signals – war and heatwaves, floods and tech disruptions, hunger and hope – suggests that systemic risks are escalating even as transitions accelerate. On the risk side, geopolitical brinkmanship tied to fossil fuels is more dangerous than ever, climate extremes are intensifying faster than infrastructure can adapt, and the social fabric is fraying under inequality and information disorder. These underscore a higher likelihood of cascading crises: e.g. a heatwave triggering blackouts that spur social unrest, or an info-war exacerbating real wars. Each breakdown in one “room” (Earth or Human) reverberates in the other.

But in parallel, the seeds of a new phase are taking root. Renewable energy scaling and fossil investment decline point to an approaching energy tipping point. Citizen assemblies for climate and rights-of-nature laws indicate governance innovations for an ecological civilization. From youth climate strikes to Gen Z’s demand for sustainable brands, we are still seeing signs of cultural values visibly shifting toward long-term planetary thinking. These are not isolated wins; they form an emerging mosaic of an alternative future.

What transitions are accelerating? The renewable energy transition is clearly moving faster than anticipated – every investor and policymaker should now plan for a post-fossil economy arriving in years, not decades. The electrification of transport hit its S-curve inflection, suggesting oil demand may peak earlier than forecasts – a potential abrupt shock to petro-states and automakers that haven’t diversified. The adaptive pivot in agriculture (to regenerative methods and diversified proteins) is gaining momentum just in time to confront climate threats to food – expect to see institutional food buyers (from school systems to the UN’s WFP) increasingly favoring climate-resilient sourcing. The notion of the “circular economy” has crossed from niche to mainstream this week, with major corporations making it part of core strategy. And perhaps most heartening: the transition in mindsets. The idea of endless growth and human separation from nature is steadily “composting,” replaced by a worldview of interdependence – evident in everything from school climate strikes to the UN recognizing a healthy environment as a human right.

What decisions matter most now? In this planetary phase shift moment, leadership choices in the next 6–18 months will lock in trajectories. Key among them:

- Energy Investment – whether governments double-down on clean energy deployment and grid upgrades (as advised by experts) or cling to propping up fossils will decide if we limit warming or drift into climate chaos. This week’s war scare and IEA data make a compelling case to reallocate subsidies and capital entirely toward clean tech. Smart leaders will seize that narrative: energy security = renewable acceleration.

- Social Contracts – decisions on fiscal policy (e.g. implementing wealth taxes or big social investments) will determine if societies can reduce destabilizing inequality. With inequality at feudal levels, doing nothing courts civil unrest and extremism. Countries that choose to “tax the rich, lift the poor” as Oxfam urges may foster more stability and innovation, whereas those that don’t could see trust in governance collapse further. Investors should watch for policy shifts on redistribution and prepare for either scenario.

- AI and Information Governance – we’re at a fork where leaders either establish robust guardrails for AI and social media or let the Wild West continue. The wrong choice could allow disinformation to derail collective action on all other fronts. Moves to require transparency in algorithms, watermark AI content, and support public-interest media are critical decisions now being weighed. This week showed both the damage and the embryo of solutions; it’s decision time on scaling the latter.

- Adaptation vs. Suffering – Finally, as climate impacts mount, officials at all levels face choices about investing in adaptation (cooling centers, flood defenses, resilient infrastructure) versus reacting to disasters after the fact. The heat fatalities and flood losses we saw are partly policy choices. Proactive adaptation spending now will save orders of magnitude in future losses. The window for orderly adaptation is narrowing – decisions in city planning and budgets today will determine who thrives and who suffers in the next big heatwave or storm.

In summary, the planet’s phase shift is speeding up – the old is burning out, the new not yet fully formed. This week’s intelligence urges us to be “pathfinders” – to consciously hasten the emergent trajectories and cut off the destructive ones. For investors, that means aggressively divesting from dying industries and bolstering innovative, regenerative enterprises that will form the backbone of a sustainable economy. For public leaders, it means enacting bold policies (on energy, inequality, information integrity) before crises force their hand. For citizens, it means recognizing our agency in this transition – through what we buy, how we vote, and the visions of the future we choose to champion. The risks of inaction are compounding, but the signals of progress are growing too. The balance of this phase shift – collapse or breakthrough – hinges on choices being made right now, this week, and in the critical weeks to come. The call to action is clear: invest in resilience, prioritize equity, and dare to redesign our systems for life after the fossil-fueled, exploitative paradigm. The data and signals are on the table; it’s time to move with purpose into the next chapter.