The world is not going to run out of oil anytime soon, but that might be precisely what drags the global economy down after 2018 — unless we wake up to the elephant in the room: global net energy decline.

Oil is here to stay — certainly the Trump administration thinks so, judging by its extraordinary ‘America First Energy Plan’ to ramp up exploitation of America’s last remaining oil, gas and coal resources.

The Trump energy plan would appear to be vindicated by BP’s new Energy Outlook, which forecasts a steady growth in demand for oil into the 2040s. The British oil and gas company also forecasts that there is more than enough oil to meet rising global demand.

BP is a powerful member of the top US oil industry lobby group, the American Petroleum Institute, whose other members include ExxonMobil, Chevron, Royal Dutch Shell and Saudi Aramco. The group is currently lobbying the Trump administration for more deregulation, offshore drilling and pipeline construction.

Face off: BP vs HSBC

BP’s Energy Outlook paints a rosy picture of the future of global oil and gas, as a viable and profitable investment opportunity. The BP report appears to stand in stark contrast to a controversial HSBC report released late last year, which INSURGE intelligence exclusively published in full in January. That report agreed that oil demand would continue surging, but offered a very different scenario of what would happen next.

HSBC predicted that supply growth would be insufficient to meet demand. So wide would the supply-demand gap be, that by 2040 the world would need to find the equivalent of four Saudi Arabias of oil production to meet demand. This would lead to an oil crunch which in 2018, or shortly after, could trigger a global financial crash of similar scale and nature to what we saw in 2008.

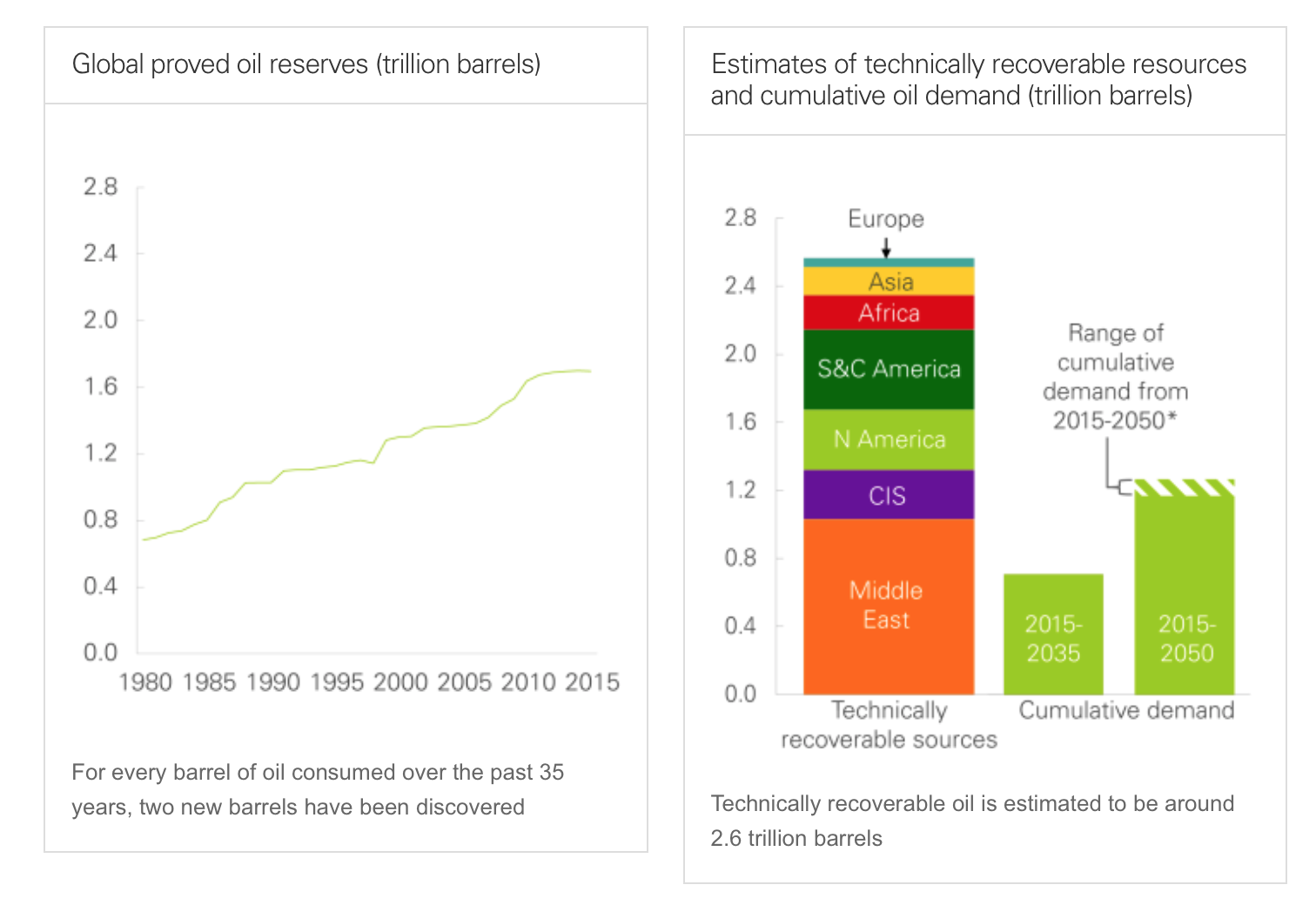

BP’s quite different oil production scenario would mean a very different future for oil prices, but not necessarily for the global economy. If BP is right that recoverable global oil supplies are around 2.6 trillion barrels, this could meet rising demand out to 2050 twice over.

The world would face a decadal oil glut. The BP report doesn’t explore in detail how this might impact prices, but it would likely offset substantial price hikes. Tepid prices, BP warned, would probably be exacerbated by weakening demand for oil driven by a combination of climate change policies and technological advances in renewable energy and electrification.

BP sees prices hovering somewhere above $55 a barrel, but nowhere near the $100 a barrel levels they reached in the years before the 2008 crash.

At this level, prices would likely still not be high enough to return much of the industry to profitability. And if that’s the case, then the economy might face a different threat to that implied by the HSBC report — weakening demand, slowing consumption, and the oil industry’s growing inability to service the trillion dollar debts already amassed.

So which forecast is correct? And what does it mean for the global economy?

Forecasting 101

Forecasting is always a risky business, but it helps to remember that from a journalistic and social science perspective, the purpose of forecasting is not simply ‘to be right’.

Rather, as my colleagues at EXILE point out, forecasts are made with a view to illuminate the potential implications of the present. And as our knowledge of the present is always limited, it makes eminent sense to explore multiple forecasts: that is, to envisage different possible scenarios based on the different choices of human agents.

In January, I integrated the data from the HSBC global oil supply report with other scientific research to offer one plausible scenario of the near future: an oil, food and financial crash in 2018, or in the years shortly after.

The new BP report offers data which points to a very different scenario.

So rather than approaching these reports in an ideological manner, seeking from the outset to agree or disagree with their findings, at INSURGE (now working in partnership with EXILE) we see these reports as equally important data points in attempting to chart an inherently uncertain future. And to navigate these data points, we will try to establish various axioms by which to explore potential scenarios.

This leads to our first axiom.

Axiom 1: Forecasting is not about inducing agreement or disagreement, or reinforcing dogma. Its best use is as a tool to facilitate scenario planning that aids in enhancing actionable knowledge.

With that in mind, let’s explore the BP report further.

Oil glut, economic slump

According to BP, the world is swimming in oil. With abundant technically recoverable resources, oil supply is not going to run low anytime soon.

BP supplements this verdict with an optimistic view of oil demand. Economic growth in Asia, Africa and the Middle East, BP argues, will drive greater consumption of oil-based feedstocks used to manufacture plastics and fabrics.

But not everyone agrees. Last year, writing for VICE, I covered a new report by the G30, a Washington-based group of financial insiders, portending that peak demand would come much sooner than BP believes.

The report found that the driving forces of the coming decline in demand for oil are climate change mitigation policies, and technological disruption leading to a dramatic shift toward clean, low carbon infrastructures. Those factors mean that demand for fossil fuels is going to inevitably reduce to a point that makes these industries economically unsustainable.

Those factors are recognised by BP, but the oil major vastly underplays their disruptive impact on the oil industry, compared to the G30 report. It’s worth noting that outside of oil majors like BP, the prognosis is generally grim.

Take this independent view from energy economist Professor Dieter Helm in his paper last April for the Oxford Review of Economic Policy, titled ‘The future of fossil fuels — is it the end?’:

“Longer term, new technologies in electricity generation, storage, and smart demand-side technologies, together with electric cars and the shift towards digitalization and new electricity-based technologies in manufacturing, will increase demand for electricity, but not fossil fuels. These new and emerging technologies… will probably bring fossil fuel dominance to a gradual close.”

Add in the impact of international climate agreements and the rapid growth of renewables, and the prognosis for the industry looks even worse.

If that’s the case, then this would vindicate the G30 argument that a coming oil glut could compound the current crisis of profitability, leading to a fossil fuel economic death spiral.

How can we tell which of these scenarios is most likely? Are we drowning in oil, or not? Are we running scarce on fossil fuel energy, or is this just doomsday fakery? And what does an accurate answer to these questions tell us about the future of global economic growth? Or the efficacy of Trump’s energy plan?

Drowning in oil, running out of oil, simultaneously

The most robust scientific research has surprisingly paradoxical answers to these questions.

Yes, we are drowning in oil. In fact, we will never really ever run out of oil. Despite that, we are almost certainly finding it more difficult to extract a certain type of higher quality oil, the kind that fueled the rapid growth of industrial civilisation through the 20th century.

This seeming paradox was explained most powerfully in a scientific paper in the journal Frontiers of Energy by Sir David King, the UK government’s former chief scientific advisor:

“We are not running out of oil, but we have reached a plateau in easy, inexpensive conventional oil production, which will be followed by a fall in production,” wrote Sir King and his co-author Oliver Inderwildi of Oxford University’s Smith School of Enterprise and the Environment. “Novel unconventional oil reserves are abundant, but are more costly to produce, provide less net energy and cause more GHG [greenhouse gas] emissions.”

Up until 2005, production of cheap conventional oil was rising exponentially. But since then, conventional production has stopped rising. According to the King paper, conventional crude oil is “a limited resource and its production is currently plateauing, at about 64 million barrels per day (mbd).”

The gap between plateauing crude supply and burgeoning world demand is being increasingly filled by “unconventional resources… now at 93 mbd.”

So as the cheaper, easier stuff is no longer growing, the world has to rely on more expensive unconventionals, like tar sands in Canada or shale gas in the US, which require costly fracking technology to extract, and more difficult processes to refine.

So HSBC’s finding that 80 percent of the world’s oil is now post-peak, remains consistent with BP’s insistence that there’s still tonnes of mostly unconventional oil.

For King and Inderwildi, both sides of the argument have a point:

“There is indeed ample potential supply of fossil fuels, however, conventional oil, which is relatively cheap to recover, can no longer meet the demand.”

Axiom 2: Conventional oil production peaked around 2005, and since then has plateaued. This does not mean oil is running out. Rather, the shortfall is being made up by unconventional sources of oil and gas which exist in abundance, although they are energetically and environmentally more costly, and produce less net energy than crude.

Many ‘peak oil’ proponents wrongly believed that after the peak and plateau of the world’s conventional oil production, oil prices would rise exponentially, and stay that way indefinitely. We now know that this forecast was dead wrong.

Instead, the economics of the shale oil and gas revolution ushered in a new era of volatile oil prices. The geophysics of shale production involves quicker depletion and decline of wells, and thus a much more rapid pace of higher frequency drilling to maintain production and profitability. This in turn produced an unconventional oil supply glut.

Yet we continue to face a more fundamental biophysical challenge: the net energy produced from these unconventional sources is much lower than what the world has been used to.

Axiom 3: The post-peak world does not in itself imply the end of the Oil Age, but merely the shift toward unconventional sources of oil and gas. This, however, also implies a transition to a new era of lower energy quality from fossil fuels. In this new era, oil prices are inherently volatile, because the supply and demand dynamics of the new oil era are different to what we’ve been used to in the age of cheap crude.

In short, the age of cheap, easy high quality crude is over. Welcome to the age of abundant, lower quality unconventionals (aka ‘Crappy Oil’).

It’s EROI, stupid!

This leads us into acknowledging the bigger elephant in the room. This elephant has rarely been part of the rather pointless non-debate between proponents and detractors of ‘peak oil’. But it’s there.

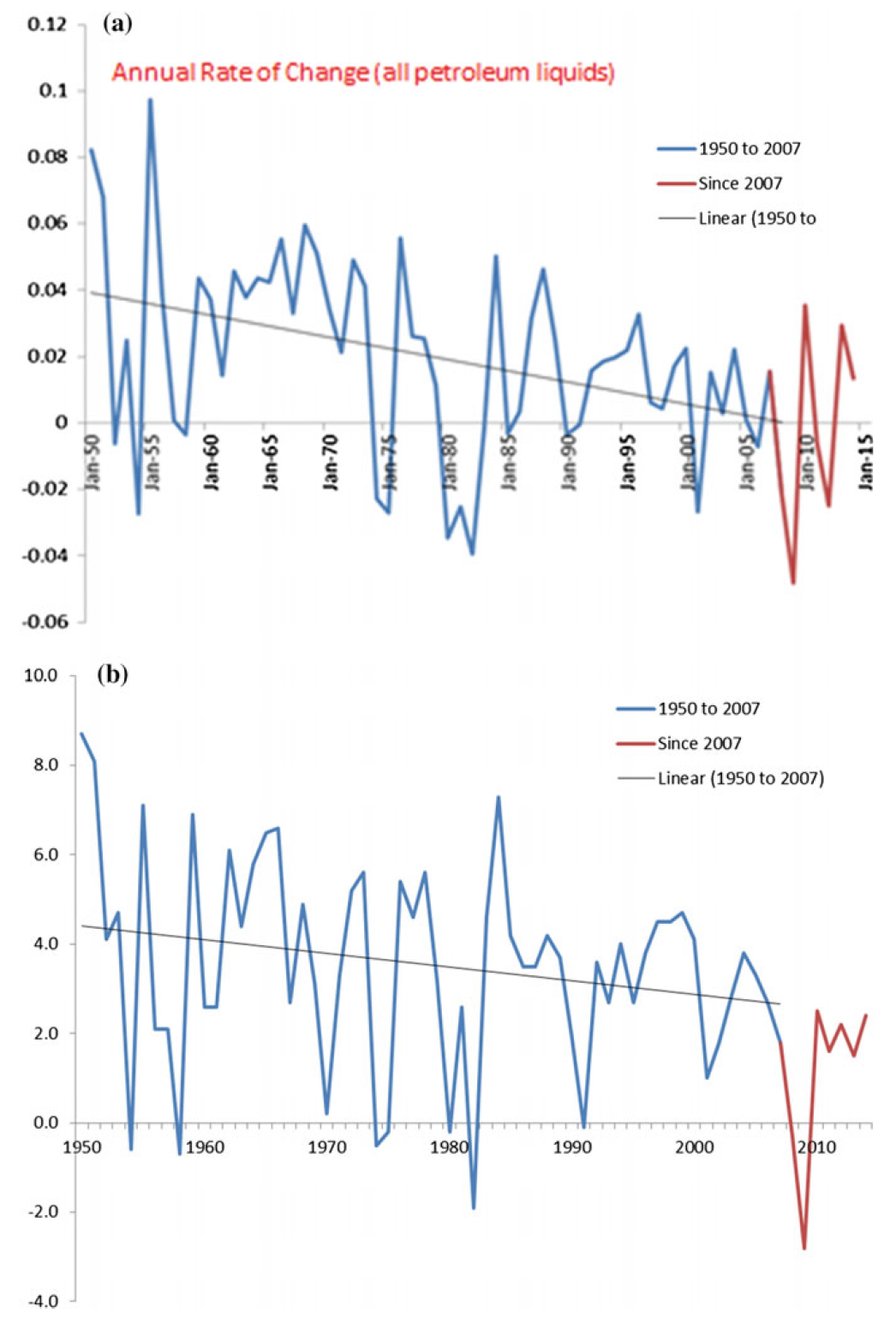

Over the last century, the net value of the energy we are able to extract from our fossil fuel resource base has inexorably declined. The scientific concept used to measure this value is Energy Return on Investment (EROI), a calculation that compares the quantity of energy one extracts from a resource, to the quantity of energy used to enable the extraction.

There was a time in the US, around the 1930s, when the EROI of oil was a monumental 100. This has steadily declined, with some fluctuation. By 1970, oil’s EROI had dropped to 30. Over the last three decades alone, the EROI of US oil has continued to plummet by more than half, reaching around 10 or 11.

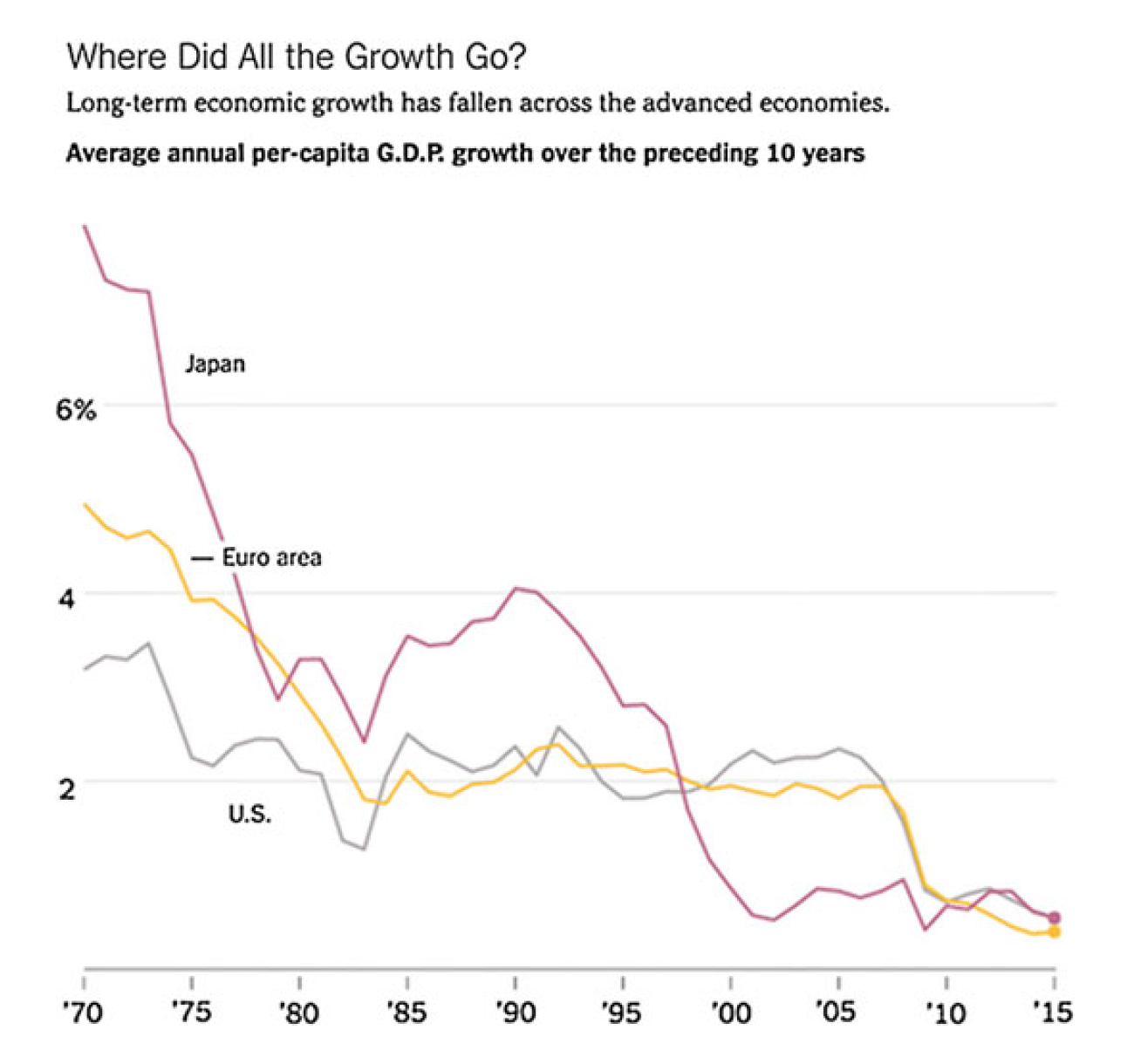

According to environmental scientist professor Charles Hall of the State University of New York, who created the EROI measure, global net energy decline is the most fundamental cause of global economic malaise. Because we need energy to produce and consume, we need more energy to increase production and consumption, driving economic growth. But if we’re getting less energy over time, then we simply cannot increase economic growth.

This has led to a number of devastating consequences. To maintain economic growth, we are using ingenious debt mechanisms to finance new economic activity. The expansion of global debt is now higher than 2007 pre-crash levels. We are escalating the risk of another financial crisis in coming years, because the tepid growth we’ve managed to squeeze out of the economy so far is based on borrowing from an energetically and environmentally unsustainable future.

And this is also why there has been an unmistakeable correlation between long-term global net energy decline, and a long-term decline in the rate of global economic growth.

So to some extent the volatility of oil prices, and the issue of how far the world’s oil supply extends, misses the bigger picture. Because the health of the global economy depends not just on the quantity of reserves — but the quality of supply.

And the quality of supply, as measured by EROI, is haemorrhaging. And that inexorable decline in global net energy is increasingly acting as a key biophysical constraint on global economic growth.

Axiom 4: Global net energy has declined over the last century. This decline correlates with a long-term decline in the rate of global economic growth. These two phenomena are not accidentally related, but causally entwined: economic growth consists of an increase in production and consumption, which is based on the extraction of energy and its conversion into goods and services.

We are finding less and less oil

There are other faultlines in this picture. For instance, the HSBC and BP reports emphasise different elements of the energy picture. BP says that estimates of technically recoverable oil reserves have now risen — whereas last year they were found to be about 1.7 trillion barrels worth, BP now estimates this to be about 2.6 trillion.

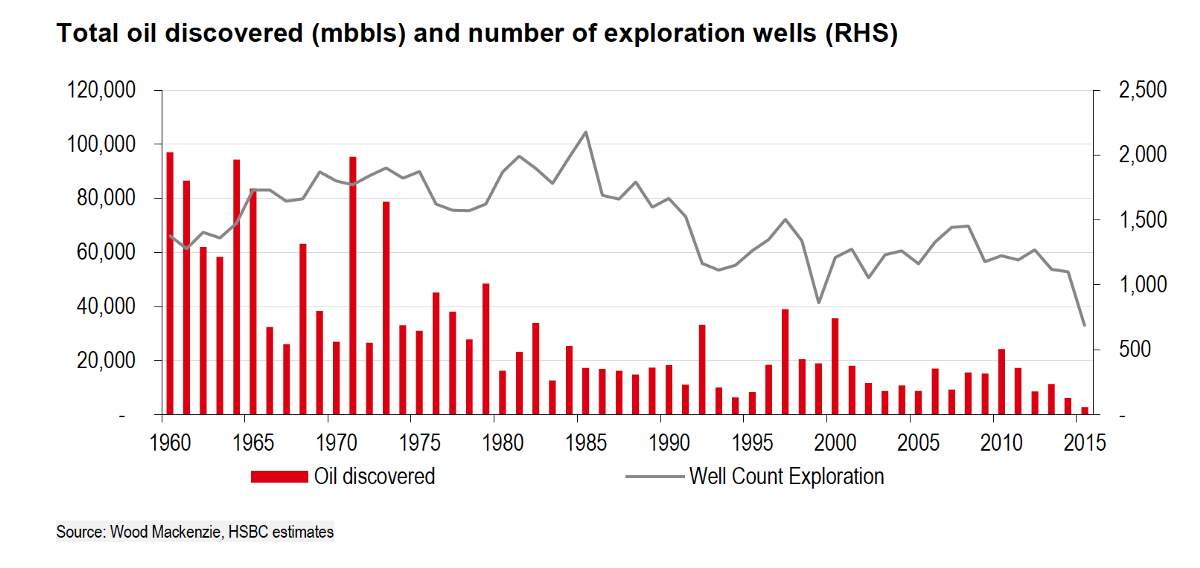

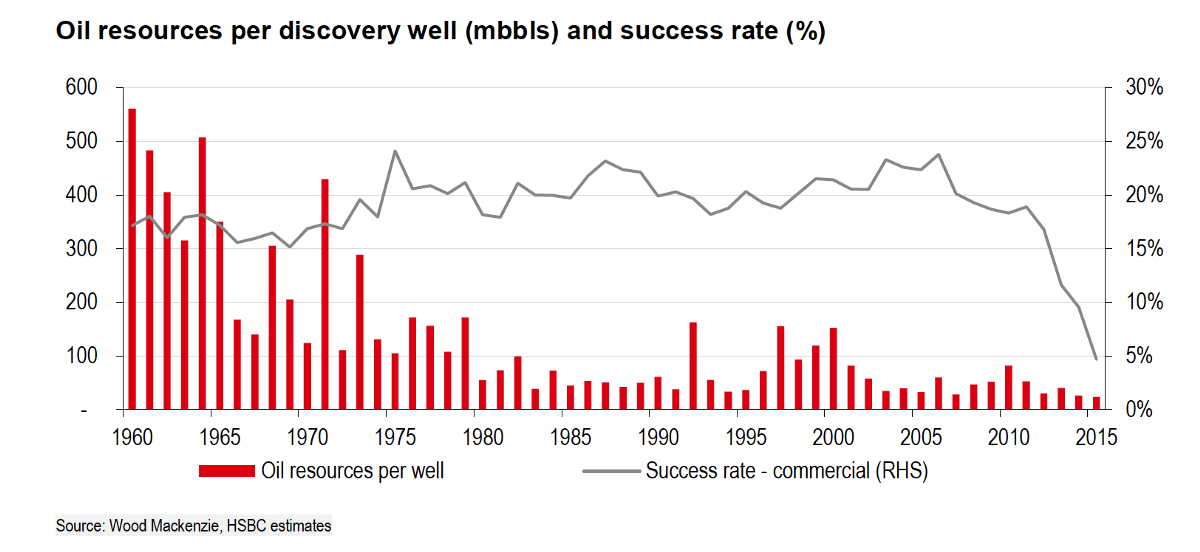

HSBC emphasises a different reality: that the actual quantity of oil discoveries is dramatically decreasing year by year, and rapidly reaching a point at which the amount of new oil we’re discovering is becoming negligible, for all intents and purposes.

How can we reconcile these seemingly contradictory facts?

How can we be finding more and more recoverable oil, when the rate and size of actual discoveries are rapidly declining?

Estimates of proven reserves are based on an analysis of current technologies in the context of anticipated oil prices, to attempt to explore what quantity of the resource base can actually be recovered.

One answer came last year in an extensive new scientific analysis published in Wiley Interdisciplinary Reviews: Energy & Environment, which found that proved conventional oil reserves as detailed in industry sources are likely “overstated” by half.

It’s all about definitions. The study is by Professor Michael Jefferson of the ESCP Europe Business School, a former chief economist at oil major Royal Dutch/Shell Group. Wiley Interdisciplinary Reviews (WIRES) is a series of high-quality peer-reviewed publications which runs authoritative reviews of the literature across relevant academic disciplines.

According to Professor Jefferson, who spent nearly 20 years at Shell in various senior roles from head of planning in Europe to director of oil supply and trading, a key basis for the expansion of ‘proved’ oil reserves slid into the industry decades ago.

He writes that:

“… the five major Middle East oil exporters altered the basis of their definition of ‘proved’ conventional oil reserves from a 90 percent probability down to a 50 percent probability from 1984. The result has been an apparent (but not real) increase in their ‘proved’ conventional oil reserves of some 435 billion barrels.”

Global reserves have been further inflated, he wrote in his study, by adding reserve figures from Venezuelan heavy oil and Canadian tar sands — despite the fact that they are “more difficult and costly to extract” and generally of “poorer quality” than conventional oil. This has brought up global reserve estimates by a further 440 billion barrels.

Jefferson’s conclusion is stark:

“Put bluntly, the standard claim that the world has proved conventional oil reserves of nearly 1.7 trillion barrels is overstated by about 875 billion barrels.”

Where does this leave BP’s latest estimate? It suggests that the higher reserve estimates are based not on actual new geophysical discoveries, but on recalculating the quantity of proved reserves based on revising the definition of what is probable. When a lower threshold of 50 percent probability is used to define what is technically recoverable, this provides a larger scope to re-assess the prospects.

Jefferson’s analysis gives us a sound scientific basis for healthy scepticism toward BP’s ever-increasing estimates of reserves.

But we still need to accept a fundamental reality. We learned from the shale gas boom that technology can make lower quality unconventional resources recoverable — and there’s no reason to assume that technological innovation in this vein will simply grind to a halt.

Axiom 5: Technological improvements will make unconventional oil and gas more accessible, and thus more recoverable in principle.

Equally, though, another lesson from the shale gas boom is that so far, technological ingenuity cannot make the quality of the energy we are producing from this vast resource base any higher. In fact, what we’ve seen is that no matter how much more and deeper we’re able to drill, the quality of energy we’re producing is now about half the value of conventional oil, and is set to decline further.

And that’s where HSBC’s insight becomes relevant:

Axiom 6: We are no longer making significant new discoveries of high quality oil, and the rate and size of fossil fuel discoveries in general are in exponential decline.

Both these axioms are related to a further fact: despite all the technological ingenuities of fracking so far, and the abundant unconventional resources remaining, the net energy of these resources is low. For instance, the best analyses of the EROI of shale oil and gas (from wellhead to bringing electricity to market) still put the figure at around 10 or 11.

Axiom 7: Global net energy continues to decline despite better and more efficient technologies of production. Technological improvements, so far, have not produced higher quality energy. It has, however, enabled us to produce higher quantities of lower quality energy, whose quality continues to decline.

So where does this leave us?

Welcome to the threshold of a global system ‘phase-shift’

In my new book, Failing States, Collapsing Systems: BioPhysical Triggers of Political Violence (Springer 2017), I argue that global net energy decline is a primary driver of the present moment of global system failure.

As global net energy is declining, to keep the endless growth machine running, the imperative to drill like crazy to get more energy out only deepens. So instead of scaling back our exploitation of fossil fuels, we are accelerating it.

As we are accelerating fossil fuel exploitation, this is accelerating climate change. That in turn is driving more extreme weather events like droughts, storms and floods, which is putting crops in major food basket regions at increasing risk.

The environmental crisis has culminated in a shocking tipping point, whereby we have breached several key “planetary boundaries” for the safe operation of human civilisation, amplifying the risk of large-scale disruption of natural systems.

As climate and food instability ravage regions all over the world, this has fueled government efforts to task their militaries with planning for rising instabilities as these processes weaken states, stoke civil unrest and even inflame terrorism. And that escalating breakdown of regional states coincides conveniently with a temptation to use military force to consolidate control of more fossil fuel resources.

This is precisely what has already happened in several key peripheral countries: Syria, Iraq, Yemen, Egypt, and Nigeria and beyond have become failing states as climate, energy, economic and food crises driven, at root, by net energy decline, have unleashed hell on earth. As state structures have crumbled, the vacuum has been filled by extremists radicalised by the geopolitical games of outside powers, emboldened by the changing landscape.

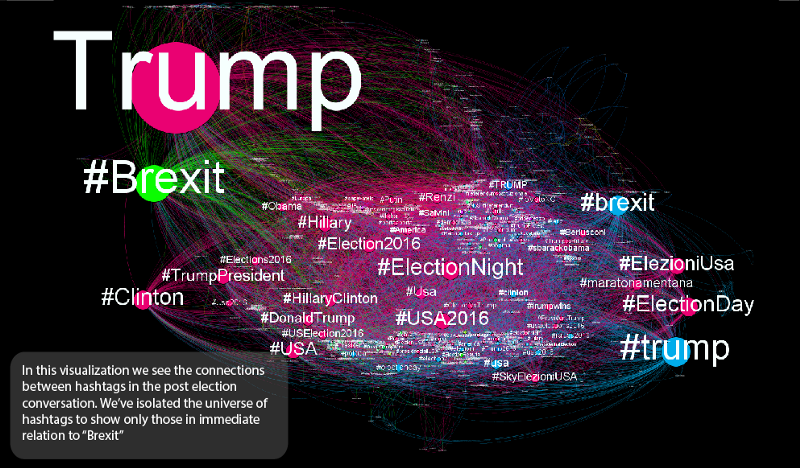

These processes can only be held at bay from the West for so long. And phenomena like Trump in the US and Brexit in Europe show that they are no longer being held at bay.

When a complex adaptive system is particularly challenged by its environmental conditions, it enters a stage of crisis. The crisis challenges the existing structures, the existing relationships and patterns of behaviour in a system. If the crisis intensifies, it can reach a threshold that undermines the integrity of the whole system. Eventually, either the system adapts by re-structuring, leading to a ‘phase shift’ to a new system, a new equilibrium — or it regresses.

In a civilisational context, the capacity to process information in such a way that it is distributed effectively across the system to contribute to resilient relationships is crucial to the system’s ability to survive, and adapt. The media institutions and processes that drive our behaviour are, in this sense, an interesting barometer of the health of the ‘DNA’ of our civilization.

The state of information overload and polarisation we are now experiencing therefore speaks to the fact that we are rapidly approaching a crisis threshold. The crisis has overwhelmed the existing structures of the global system. Our prevailing institutions and systems of power are in informational disarray as they struggle to make sense of what appears to be an overload of information signalling this systemic crisis.

At this point of threshold, the system faces a crisis of information overload, and an inability to meaningfully process the information available into actionable knowledge that can advance an adaptive response. Hence, for instance, the increasingly toxic polarisation of all political discourse. And certainly in the case of the ‘peak oil’ debate, the inability to engage constructively with seemingly contradictory evidence.

Axiom 8: Global net energy decline plays a driving role in the acceleration of interconnected climate, energy and food crises, which in turn have escalated toward a threshold of global systemic crisis. One of the most direct symptoms of this crisis threshold is information overload, resulting in polarised, exclusionary bubbles of competing ‘truth’.

The astonishing emergence of the Trump coup is a direct symptom of this process. Information overload amidst systemic crisis facilitated the most regressive but all too common responses to crisis: ‘Otherization’.

Rather than an adaptive response based on a whole systems understanding, information overload — along with a deeply inadequate approach to understanding global systemic crises — allows short-sighted reactionary thinking to take the lead. Thus, the blame falls on particular groups of people identified as ‘the problem’, rather than diagnosing the structures of the system itself.

Rather than a transformative systemic response into a new adaptive ‘phase-shift’, we see a powerful cross-sector political economic faction with vested interests in the current structure of the global system engaged in efforts at systemic consolidation.

Their reaction is based on the erroneous view that the ‘crises’ now escalating are external to the system in question — in this case, these externalities are constructed simply as problematic group identities, perceived as having a parasitical impact on an otherwise optimal system.

In reality, this narrow reaction, by reinforcing the very deep structures that are escalating the processes of global system failure described, escalates the threshold of crisis. This maladaptive response represents a serious systemic regression, that heightens the risk of crisis and collapse.

Scenario planning: beyond business-as-usual

We need to be able to overcome this state of information overload by developing a holistic information architecture that operates on a fundamentally different basis to the sort of journalism that prevails at the moment.

That’s why rather than simply allowing my own diagnosis to polarise dogmatically around one exclusivist position or scenario, I’ve tried to show that a more meaningful and powerful response involves constructive and critical engagement with multiple opposing positions.

This journalistic methodology for open inquiry is what we’re co-developing at INSURGE and EXILE, who I’m working with to build the next generation media platform that can underpin a more inclusive, generative and empowering information architecture for people and planet.

In service to that goal, in my Failing States, Collapsing Systems book, I outline two potential scenarios as follows:

- The lower resource quality (EROI) of the global energy system may act as a fundamental geophysical ceiling on the capacity of the economy to grow. It may act as an invisible brake on growth in demand, potentially meaning that fossil fuel prices would remain at chronically low levels endangering the profitability of the fossil fuel industries. This would lead to an acceleration of the demise of the fossil fuel industries, which would in itself raise the question of debt-defaults across the industries feeding back into the financial system. Endangered hydrocarbon energy production would feed back into the global system as a further lowering of resource quality, manifesting in a protracted and self-reinforcing recessionary economic process. This would escalate vulnerability to water, food and energy crises and hugely strain the capacity of European and American states to deliver goods and services to their own populations.

- Scarcity of net exports on the world market may manifest in a resurgence of oil prices. This may return some sectors of ailing fossil fuel industries to a modicum of profitability. However, previous slashing of investments and cutbacks in exploration — much of which has already taken place — will mean that only the most powerful sections of the industry would be able to capitalize on this, meaning that production is unlikely to be able to return to previously high levels. Price spikes would trigger economic recession, causing a drop in demand, while lower production levels would exacerbate the economy’s inability to grow substantially, if at all. In effect, the global economy would likely still experience a self-reinforcing recessionary economic process.

In scenario 1, oil prices stay relatively low.

In scenario 2, oil prices go high.

We don’t know enough about the system dynamics of our present configuration to pinpoint for sure which scenario is more likely — the relevant scientific and industry literature is conflicted on it, as the BP and HSBC reports demonstrate.

However, axiomatically, the preceding investigation allows us to deduce that neither scenario suggests the possibility of escaping the current threshold of systemic crisis on a business-as-usual trajectory.

It’s precisely in this exploration of two possible, counterposed scenarios that we are able to envisage the possibility, if not the necessity, 0f acting in a way that opens an alternative path to business-as-usual.

Both scenarios suggest that the incumbent fossil fuel industries will face serious and ultimately fatal disruption in coming decades, no matter which way oil prices go.

Both scenarios suggest that global economic growth is being increasingly biophysically constrained by global net energy decline premised on continued fossil fuel dependence.

Both scenarios suggest that the United States and Europe face increasingly unstable geopolitical futures, and escalating challenges to their internal territorial integrity driven by a rise in short-sighted ‘Otherization’, without a fundamental change of course.

Both scenarios, therefore, suggest that in order to overcome our present threshold of crisis, a new adaptive, transformative systemic response is urgently required.

The first precondition for the success of this ‘phase-shift’ to a new adaptive systemic configuration is that the components of the system wake up to what is happening and why — in a truly holistic and systemic sense.

The present moment, while at once signalling our approach toward the pinnacle of the crisis threshold, simultaneously signals the unprecedented opportunity for a wide range of groups across left and right, conservative and liberal, to become truly awake to the systemic nature of the crisis.