I’ve spent years tracking the turbulence of our times – the converging crises, the economic uncertainties, the political whiplash. Yet even as we navigate what feels like a global breakdown, I see the outlines of an unprecedented breakthrough. A new circular economy paradigm is emerging from the wreckage of the old linear model. I believe that the circular economy – exemplified by initiatives like the Una Terra Early Growth Fund – is poised to become one of the fastest growing sectors of the global economy over the coming decade. Crucially, this isn’t happening just because it’s morally right or environmentally friendly (though it is), but because of fundamental economics.

Unfortunately, many conventional commercial research forecasts see a future of steady-but-unspectacular expansion. But those forecasts are likely to be wrong, because they fail to understand the actual drivers of systemic change across core economic sectors. When we do that, a very different picture emerges: one of massive, exponential opportunity in the circular economy space out to 2030.

A Civilisation at the Crossroads: Polycrisis and Phase Shift

We are living through what some call a polycrisis – multiple overlapping crises across climate, energy, food, politics, and more. In recent research, I’ve described this moment using Planetary Phase Shift theory, which fuses ecological and societal data to understand civilisational change. The picture it paints is stark but also illuminating: humanity is entering the “back loop” phase of an adaptive cycle – the period of collapse and reorganisation that comes after a system’s long growth and conservation. In other words, the turmoil we see (pandemics, supply shocks, geopolitical strife, ecosystem breakdown) are symptoms of the last stage of our existing industrial lifecycle, potentially heralding its end – but also clearing space for a new system to emerge.

This “back loop” is not just an ending; it’s a turning point. It’s the chaotic juncture at which the old structures break down, releasing resources and opening up niches for innovation. What comes next depends on the choices we make now. Will we slide into outright collapse? Or can we foster a new economic paradigm that fundamentally transforms how civilisation operates?

A mountain of emerging evidence suggests not only that we can, but this is the only route to avoiding collapse. We see this in a wave of disruptive innovations across the five foundational systems of human civilisation – energy, food, transport, information, and materials – that together signal the birth of a new paradigm.

Already have an account? Log In

Converging Disruptions in Energy, Food, Transport, Information, and Materials

Each of civilisation’s key production systems is undergoing historic disruption. These aren’t isolated changes; they reinforce one another, jointly driving what a global phase shift in our production system. Let’s briefly look at each:

- Energy: The shift to clean energy is well underway. Solar photovoltaic costs have plummeted by 90% in the last decade, onshore wind by 70%, and battery storage by over 90%. We’ve reached a tipping point where renewables are often the cheapest power source available. Projections based purely on economics (ignoring any climate policy) show solar and wind on track to dominate global energy markets by mid-century. This isn’t wishful thinking – it’s happening because of exponential technology learning curves and economies of scale. Cheap, abundant clean energy is coming online, undermining the fossil fuel model that underpinned the old linear economy. Zero-marginal-cost clean power is a game-changer for every circular flow that is energy-intensive today (aluminium, glass, plastics depolymerisation, low-temperature e-fuel synthesis).

- Transport: Transportation is electrifying and digitalising. Electric vehicle (EV) adoption has followed a classic exponential curve, doubling in global market share over the past few years. EVs are seeing rapid cost declines and performance gains; analysts project they will achieve market dominance (outselling gasoline cars) within the next 10–15 years. Meanwhile, innovations in autonomous driving and “transport-as-a-service” models point toward a future with far fewer privately owned cars and far more efficient use of vehicles. This is a direct threat to the old oil-driven transport paradigm and paves the way for drastically lower material and energy use in mobility (imagine fleets of durable EVs continuously in use, instead of personal cars sitting parked 95% of the time). EVs are one of the biggest drivers of battery storage learning curves – and batteries will increasingly become a second-life feed-stock for stationary storage, turning end-of-life liabilities into assets.

- Food: Perhaps the most surprising disruption is in agriculture and food production. Precision fermentation and cellular agriculture – essentially brewing proteins in the same way we brew beer – have seen steep cost declines. Food scientists now project that these technologies will completely disrupt traditional animal farming. Within the next decade or two, we could produce proteins (meat, dairy, eggs) far more efficiently without livestock. The implications are staggering: up to 2.7 billion hectares of land currently used for pasture and feed crops could be freed up for other uses – rewilding, reforestation and regenerative agriculture – as animal agriculture recedes. This isn’t just about veggie burgers; it’s a wholesale shift in how we meet one of humanity’s core needs, decoupling protein production from the massive resource demands and emissions of industrial farming.

- Information: The digital and information sector has been disrupting itself continuously – from the internet and smartphones to now artificial intelligence. The latest leap, generative AI, is on an exponential trajectory in cost and performance. AI’s significance here is twofold. First, it’s enabling smarter systems: AI can optimise energy grids, supply chains, and industrial processes, boosting efficiency (a boon for circular models). Second, AI – particularly applied to robotics – is ushering a new era of automation which can greatly aid the transition to a circular, post-carbon economy by improving design, monitoring and coordination across all other sectors. Generative AI and Internet of Things slash design, tracking and remanufacturing costs across value chains. Digital product passports, predictive maintenance and reverse-logistics orchestration will move from pilot to default.

Materials are of course the heart of the circular economy revolution – fundamentally rethinking our materials and manufacturing systems. Our current linear model is incredibly wasteful: we recycle only about 9% of the materials we extract, while a whopping 62% of global greenhouse gas emissions come from the raw resource extraction, processing, and production of goods. That linear “take-make-waste” approach is reaching breaking points. In contrast, emerging circular approaches aim to keep materials in play indefinitely through recycling, reuse, remanufacturing, and innovative product design. We’re seeing new breakthroughs in everything from advanced recycling technologies (for plastics, electronics, batteries, etc.) to biodegradable materials and modular design principles that make products easier to disassemble and recover. In short, the materials sector is reinventing itself around the principle of resource circularity, moving away from reliance on virgin extraction. This shift is synergistic with the other disruptions: for instance, abundant clean energy allows more intensive recycling and material recovery without prohibitive cost (more on this below).

Crucially, these disruptions are converging and reinforcing each other. Cheaper renewable energy makes processes like recycling and industrial electrification economically viable at scale. Electrified transport removes oil from the equation and integrates vehicles into the clean energy grid (EV batteries can even feed energy back). Precision fermentation and vertical farming powered by abundant clean energy reduce land and water pressures, easing biodiversity loss and potentially providing organic feedstock for biomaterials. Advanced information systems tie it all together, optimising resource flows and matching supply with demand in real-time.

These interacting S-curves create cascading positive feedbacks. For example:

Cheap renewable electricity ➔ cheaper electro-refining & polymer recycling ➔ lower circular-material prices ➔ bigger pull for reuse-based business models ➔ more policy support & investment, which feeds back into faster renewable build-out.

From a systems perspective, what we are witnessing is the technological side of the early “reorganisation” phase of a new civilisational cycle. As the old institutions and industries struggle, these new technologies and models are rising to take their place, not because of altruism but because they outperform the status quo. We’re transitioning from an era of extraction to an era of regeneration and circularity.

As I’ve said before, technology is only one side of this equation – the other is a fundamental social, economic and cultural paradigm shift in how we operate these emerging technologies (a new OS). But the technology trends make clear that there is an inexorable direction of travel which has tremendous implications for global markets.

Already have an account? Log In

Why Circular Models Will Outcompete Linear Ones

If the above sounds overly optimistic, consider this key point: circular economy solutions are starting to outcompete linear, extractive models on pure cost and efficiency grounds. In my own work stress-testing different future scenarios, I’ve been struck by how the economics of circularity improve as other disruptions advance. For example, the combination of cheap solar power and battery storage could enable a global circular manufacturing system that uses 300 times less material input by weight than the present fossil-fuelled system. Even achieving a fraction of that would radically reduce dependency on virgin mining and deforestation. And the increasing efficiency of recycling technologies now means that over the next decades, we can envisage reaching full materials circularity potentially reducing the need for new mining to near zero.

There are a few fundamental reasons circular business models are gaining a structural advantage:

- Resource Efficiency = Cost Savings: Circular models wring much more value out of each unit of resource. Recycling materials means you pay less for new raw inputs. Reusing products or components avoids manufacturing costs. Designing things to last or be shared (as in product-as-a-service models) means fewer units need to be produced overall to meet demand. All of this translates to lower costs once the system is up and running. We’re now at the point where these savings increasingly outweigh the upfront costs. For instance, reusing metals from “urban mines” (old electronics, scrap, etc.) is often cheaper than the volatile prices of mining new ores – especially now that energy to recycle is cheaper and technology to recover materials has improved.

- Insulation from Supply Shocks: The past few years (and indeed months) have shown how fragile global supply chains for raw materials can be. A pandemic, a war, or trade tensions can send commodity prices skyrocketing and leave manufacturers in a lurch. Many companies learned this the hard way with semiconductor shortages or critical minerals. As a result, access to raw materials has become the No.1 risk factor for companies economically and geopolitically. The circular economy offers a way out: by recirculating materials domestically or within trusted loops, companies reduce exposure to geopolitical supply disruption and price volatility. This approach can create a new paradigm of ‘materials sovereignty’ – securing critical materials supply by boosting recycling and substitution rather than relying solely on imports. In short, circularity is a strategy for resilience. That’s why one industry analysis concluded that the circular economy is more than a sustainability initiative – it’s now a strategic lever for supply security, cost stability, and long-term competitiveness.

- Policy and Regulatory Tailwinds: Even where market incentives alone might not suffice, governments are increasingly pushing in the circular direction. The EU’s Circular Economy Action Plan, China’s circular economy laws, and various national regulations on waste and recycling are creating a more favourable playing field for circular businesses. Regulations that make waste disposal costly, or that mandate recycled content, for example, directly benefit companies set up to use secondary materials. Meanwhile, carbon pricing and emissions rules penalise the extractive, wasteful processes of the linear model. Over time, this policy environment is tilting in favour of circular approaches that reduce pollution and resource extraction. Circular economy measures are also often seen as more directly tied to industrial strategy and job creation, thus garnering bipartisan support in many cases.

- Technology and Scale: Many circular technologies have matured and scaled to a point where they are effective and affordable. Recycling techniques for complex products (like lithium batteries, wind turbine blades, or mixed plastics) have improved dramatically. Digital tracking (using blockchain or RFID, for instance) now allows better recovery of products at end-of-life. The rise of the Internet of Things means we can monitor the condition of equipment and reuse or service it before it breaks. All these innovations mean that implementing circular models is becoming easier and more profitable. As circular enterprises grow, they also benefit from economies of scale. What was once a niche ‘eco’ idea is now competitive industrial practice.

To be sure, the circular economy is not gaining traction because CEOs suddenly grew an environmental conscience. It’s taking off because it offers real economic advantages in a time of turbulence. Companies adopting circular practices are hedging against resource risks and often cutting costs. Nations investing in circular systems are looking to build more self-reliant, efficient economies. And importantly, consumers are starting to get on board too, especially when circular products or services prove cheaper or higher-quality (think refurbished electronics or car-sharing networks).

But this is just the beginning. With the International Energy Agency’s Global Critical Minerals Outlook 2025 warning that access to critical minerals is becoming increasingly centralised, and therefore subject to geopolitical and supply-chain risks, the imperative to invest in materials sovereignty – the ability to reuse minerals and materials in circular fashion – is going to exponentially increase.

It’s therefore going to make more and more economic and geopolitical sense to invest in circular economy solutions that reduce dependence on far-flung supply-chains.

ESG’s Setback and the Rise of Systemic Investing

Of course, ESG investing (Environmental, Social, Governance) was all the rage – until Donald Trump retook the White House for his second term. ESG is now equated with ‘woke capitalism,’ and several states launched legal attacks to bar public funds from considering ESG factors. As a result, ESG-branded funds are bleeding capital, while investors pull out amidst the backlash and confusion. In the first quarter of 2025 alone, investors withdrew a record $8.6 billion from global sustainable funds, largely in reaction to US political moves against climate and social initiatives. In the US, sustainable funds have now seen ten straight quarters of outflows – over two years of money rushing for the exits.

While what’s happening with ESG is a setback for the sustainability sector, the reality is that there were so many flaws with the ESG approach that this development may still clear the way for a more profound shift toward investing in true sustainability winners. That’s because the circular economy’s rise is being driven by systemic economic fundamentals rather than just ethical preferences and environmental concerns. This makes it politically more palatable and financially more robust. In conversations with investors, I’ve sensed a change in tone. Many are saying, in effect, ‘Forget the ESG label – I just want assets that are future-proof.’ And future-proof increasingly means aligned with the disruptive trends above: clean energy, climate resilience, resource security, efficiency.

Funds like Una Terra VC (and others in Europe, Asia, and beyond) are positioning themselves accordingly – not as ‘ESG funds’, but as highly-commercial opportunity funds targeting the next economy. So here’s the kicker: the next economy happens to be circular and green by design, because that’s where the technology and resource landscape is increasingly pointing.

There’s a growing recognition that pouring money into circular ventures isn’t about virtue signalling, but about getting in early on the biggest growth story of the 21st century. Meanwhile, clinging to linear economy investments (coal mines, oil wells, take-make-waste manufacturing) is starting to look like a value trap – these assets could strand and underperform as disruptions accelerate.

In essence, the decline of the ESG fad is making room for something deeper: investing based on systems transformation. It’s less about scoring companies on a checklist and more about asking, “Which business models will thrive in a world of cheap clean energy, climate volatility, and resource constraints?” The circular economy answers that question. It’s a thesis of prosperity through necessity and innovation, not through corporate box-ticking. And because it’s driven by economics, it may avoid the partisan rancour that plagued ESG.

The Circular Economy: Poised for Expansion

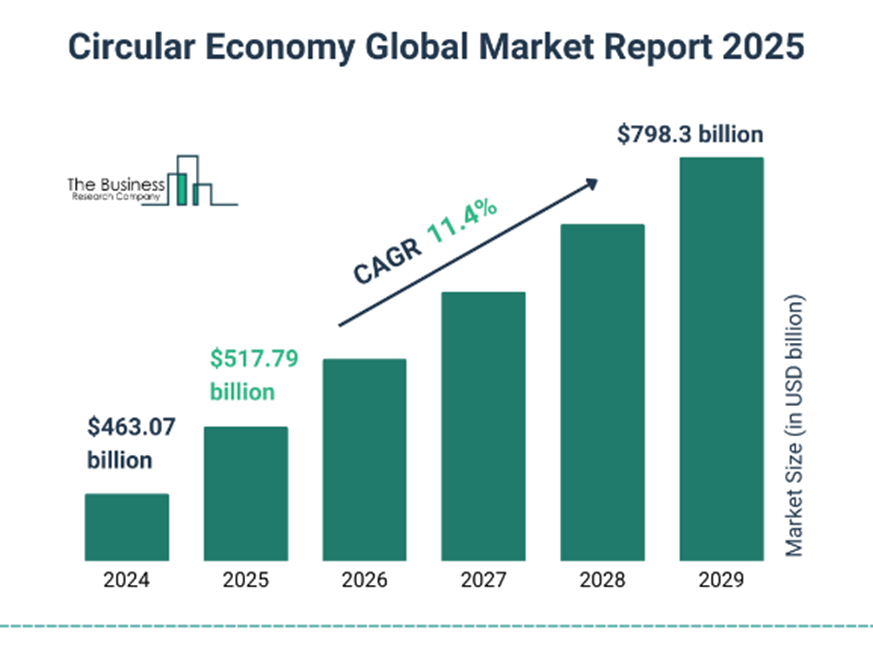

All these factors are translating into remarkable market momentum. The circular economy sector – which encompasses industries like recycling and waste valorisation, refurbishing and remanufacturing, sharing platforms, sustainable materials, and more – is on a growth trajectory that stands out even in a tech-disrupted global economy. Forecasts consistently show double-digit annual growth for circular economy activities over the coming decade.

For instance, one analysis projects the market’s value will climb from $0.5 trillion in 2024 to $0.8 trillion by 2029. That’s an annual growth rate of roughly 11–12%, outpacing many traditional sectors. Other forecasts are even more aggressive, anticipating 15% or higher yearly growth as circular solutions scale up in major markets.

But conventional market studies are likely to be very conservative. That’s because they none of them acknowledge the pace and scale of foundational technology disruptions, their interconnected dynamics, and the result cost-structure shocks on materials flows in their projections. Here’s a breakdown:

|

Source |

Base year value |

Forecast horizon |

CAGR |

Implied 2030-33 value |

|

MarkNtel Advisors (Oct 2023) |

US $ 553 bn (2023) |

2030 |

≈ 13 % |

≈ US $ 1.3 tn (MarkNtel Advisors) |

|

Roland Berger / German BMU (2021) |

€ 148 bn (2020) |

2030 |

≈ 6 % |

€ 263 bn (Deutsche Bank) |

|

Spherical Insights (Sept 2024) |

US $ 554 bn (2023) |

2033 |

13 % |

US $ 1.9 tn (GlobeNewswire) |

|

Kings Research (Nov 2023) |

US $ 584 bn (2023) |

2031 |

22 % |

US $ 3.2 tn (Kings Research) |

These forecasts are almost certainly far too low. The Ellen MacArthur Foundation already sizes circular-food benefits alone at US $ 2.7 trillion a year by 2050 – bigger than many “total market” numbers quoted above. Another analyst estimates that by 2050, the global circular economy market could reach $7.9 trillion by 2050.

So what’s happening here? They derive from extremely conservative projections of the transformation underway. They extrapolate linear demand signals from individual waste-management and recycling niches, leaving two blind spots:

- Sectoral myopia – forecasts treat energy, transport, food and information systems as independent markets.

- Static incentives – they assume today’s energy prices, material costs and policy pressures stay broadly unchanged.

Conventional analysts have failed over the last three decades to forecast the pace and scale of disruptions in energy, transport, food and information. The Planetary Phase-Shift analysis shows all four foundational systems are simultaneously crossing tipping points.

This means that as these disruptions accelerate, so too will the incentives and markets around them – including therefore around a circular economy.

Integrating the cross-sector feedbacks into a simple system-dynamics model (learning-curve-driven cost decline + policy S-curve adoption) yields a very different picture:

Phase 1 (2023-27): enabling technologies reach cost parity. Market grows ≈ 20 % CAGR as first movers scale.

Phase 2 (2028-35): policy & finance flip the incentive structure; adoption becomes default. Growth accelerates to 30-35 % CAGR, pushing market value toward US $ 8-10 trillion by 2035 (≈ 8 % of projected global GDP).

Phase 3 (post-2035): saturation of core materials flows; growth moderates to GDP-plus as service-based models dominate.

Hence, even the most upbeat conventional outlook (Kings Research: US $3 trillion by 2031) undershoots by a factor of 3 when cascading systemic effects are incorporated.

And this is why it’s critical for fund managers and investors to realise that while ESG might be in retreat, the place to put investment is in the circular economy sector. Unlike the old linear sectors which are mired in stagnation or facing decline (consider fossil fuels where all the majors are experiencing marked profit declines), the circular paradigm is in its infancy with a long runway ahead that will only accelerate along the S-curve of disruption.

If the last era was defined by building up the global consumer economy through linear expansion, the next era will be defined by rebuilding the economy on circular principles – replacing wasteful value chains with regenerative ones, replacing one-off sales with circular services, and replacing resource extraction with resource stewardship. Each replacement is an economic opportunity.

Strategic Take-aways

- Ignoring cheaper renewable energy doesn't make sense anymore: Companies investing heavily today in mining, chemicals, or heavy industries without considering rapidly falling renewable energy prices (less than \$20 per megawatt-hour) risk getting stuck with expensive, outdated technology. In other words, investing in old-fashioned energy-intensive methods could soon become financially disastrous.

- The value is shifting from digging things up to using information and smarter design: Businesses used to make most of their money from extracting raw materials. Now, the real profits will come from better data, smarter design, and digital tracking—knowing exactly how to reuse and recycle products, powered by technologies like artificial intelligence and digital "product passports."

- We need to invest upfront to benefit later: Building a circular economy requires bigger upfront investment but has much lower running costs in the long term. Governments and banks should provide early financial support because this initial investment will deliver huge benefits economically, environmentally, and socially over time.

- We need better ways to measure real value: Our traditional economic measures like GDP don't fully capture the value created by the circular economy. We should use metrics that show how efficiently we're using materials and how much carbon we're saving—these give us a clearer picture of real progress and economic health.

- Timing matters for policy: Policymakers should coordinate renewable-energy goals closely with circular-economy targets. Otherwise, we might accidentally lock ourselves into recycling processes that still use a lot of energy, undermining the whole purpose of a circular economy.

Bottom line: The circular-economy market is not a slow-burn niche; it is riding the same mutually reinforcing disruption waves that are dismantling the 20th-century industrial system. When those waves are viewed as one coupled system, the addressable value pool balloons into the multi-trillion-dollar range within the next decade – several times larger and faster than the linear extrapolations that dominate current analyst reports.

Conclusion: From Collapse to Transformation

My work on the planetary phase shift doesn’t shy away from the possibility of collapse. But it also teaches me that collapse and creation are two sides of the same coin. The “back loop” of our civilisation’s cycle is frightening, yes, but it’s also a time when possibility is at its highest. Old rules and entrenched incumbents lose their grip; new ideas and models can flourish. The rise of the circular economy is, I believe, one of the strongest signals that a great reorganisation is in progress amidst the chaos.

This shift isn’t about utopian idealism – it’s driven by a cold, hard alignment of necessity and advantage. We have to change how our economy works to survive on this planet. Now we have extraordinary emerging tools to accelerate this, making it simply smarter to change. Reducing waste, looping materials, decentralising production, regenerating resources – these are increasingly going to be seen the pragmatic choice for firms and governments, not just the ethical one. As a result, we are likely to see the circular economy soar even if many political leaders remain in denial about climate or sustainability. Economic gravity is doing the work. What was once a moral imperative is now also a business imperative.

Of course, the circular economy’s ascendance doesn’t automatically fix all problems – much depends on how this transition is managed. We must ensure it scales fast enough to outpace the breakdown of the linear system, and that it’s implemented in ways that are just and inclusive. There will be losers as well as winners in the shift (incumbents in extractive industries, regions dependent on linear commodity trade, and so on). Navigating those challenges requires conscious effort and policy support. But the bigger picture is that a new economic foundation is being laid in real time, one that could undergird a sustainable civilisation for the 21st century and beyond.

The circular economy and its allied sectors are set to drive the next great wave of prosperity – a prosperity defined not by how fast we can extract and consume, but by how intelligently we can reuse, recirculate, and thrive within our means. This is the story of transformation amid collapse. It’s not a fairy tale of avoiding the fall; it’s the more realistic story of building something new from the broken pieces. The numbers, the science, and the economics all point to the same conclusion: the circular economy is not just good for the planet – it’s poised to become the engine of our next economy. Let’s make sure we seize that opportunity.

If you appreciated this piece, you can keep this free newsletter alive and thriving by joining our community as a Supporter for the price of a cup of coffee a month.

Already have an account? Log In