“The way that a national economy preys on its internal colonies is by the destruction of communities”

— Wendell Berry

The creation of money with interest has two main impacts on the operation of today’s economies.

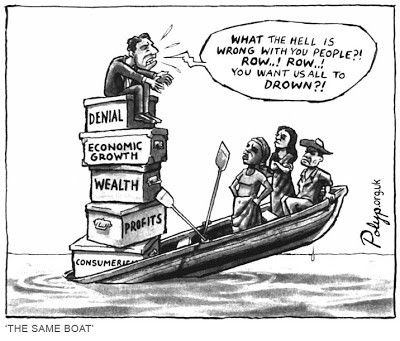

Our monetary system creates the need for economic growth by design

One of the most important lessons of the economics dimension of Gaia Education’s online course in ‘Design for Sustainability’ is to understand that the current design of our money system has an inbuilt growth imperative. Let’s go over this again: Consider that over 90 per cent of the money in circulation has been created by banks as debt. Borrowers are obliged to repay both the capital and interest. The only place more money can come from in order to pay this interest is an expansion in the money supply overall — new loans issues and debts entered into in order for the system to keep functioning.

For economic growth to take place new investments have to drive further loans (debts) to be issued and this in turn stimulates more rapid economic growth. To keep the wheel spinning, consumption has to keep growing. We have created a material culture that is addicted to the rapid exploitation of non-renewable natural resources and levels of fossil fuel consumption that are driving us beyond humanity’s safe operating space, beyond planetary boundaries and towards a future of catastrophic climate change. The spiral of degeneration and decrease in whole systems health and viability will continue, if we do not respond promptly, globally collaboratively, and decisively as one humanity.

The creation of a money system that pays differential interest to lenders and borrowers, by design creates a system that needs exponential growth in order to keep going This is because, as the size of the economy grows year on year, so the volume of required interest repayments increases, even if the interest rate remains the same. This is called the compounding of interest, or compound interest. As a result of compound interest, our money necessarily follows an exponential growth pattern: at 3% compound interest, it doubles in 24 years; at 6%, it takes 12 years; at 12%, 6 years (Martenson 2011).

The amount of money in the global economy is currently shooting up the steep end of the exponential growth curve. The speculative economy or ‘finance sector’ of Wall Street or other stock markets trading in futures and derivatives has decoupled from the rest of the economy since the beginning of this century.

For example in 2008, the global volume of good and services produced totalled US$ 70 trillion (1 with 12 zeros!), while the value of all financial assets in the world peaked at US$ 194 trillion.

Derivatives opened the floodgates on the global casino, but with the difference that banks were able to bet many times more the amount of money they really had. You would not be allowed to do that in Las Vegas. Money and Life is yet another eye-opening documentary (86mins) which will help you to understand urgency and opportunity of changing the way we understand and use money.

It is critically important to understand that our globalized monetary system has exponential growth rates in consumption of raw materials and depletion of natural resources practically designed into it.

This means no matter how much we shift towards sustainable and regenerative practices in all other aspects of our lives, unless we address the structural dysfunctionality of the growth imperative in our current economic and monetary systems we are unlikely to succeed in transitioning to regenerative, resilient and sustainable cultures.

To redesign the human presence on earth is also to redesign our monetary and economic systems.

To show the impact on money in the long run, we may use the famous example of Josephs’ cent invested at 5% interest in the year 0. In the year 2000 this cent would be worth over 500 billion balls of gold of the weight of the earth, at the price of gold in that year. Without the compounding of interest, the sum accumulated would have been €1.01.

— Margrit Kennedy, 1995

There is always a relatively low, background level of bankruptcies occurring in any economy as some businesses fail. However, if an economy stops growing, the wave of bankruptcies grows as impacts cascade through the economy and businesses and their suppliers fail. This hits demand as the salaries of laid-off workers are lost and people don’t have the money to consume further.

As the number of unemployed people rises, government tax revenues drop sharply and in European style social-economies this leads to increased government spending as the money spent on welfare payments and unemployment benefits rises. At this stage, the economy risks descending into a downward spiral characterised by waves of falling purchasing power, ever-widening bankruptcies, and rapidly rising numbers of unemployed.

Consequently, even those politicians who understand that indefinite growth within the confines of a finite Earth is a logical impossibility are more or less powerless to do anything to slow, stabilise or contract the economy so long as we have money systems based on debt and interest payments.

We are systemically locked into the effects of the growth imperative designed into our economic system by the kind of money system we created. This is not inevitable! Since the system was created by human intention and design, we have the possibility to re-design the system.

Awareness is rising that we cannot expect different results, if we keep doing the same thing or leave the same dysfunctional system in operation. The calls for a redesign of our monetary and economic system are getting louder and more widespread.

Our monetary system transfers wealth from the poor to the rich (by design)

“In Germany in 2004, about one billion Euros found their way from the 80 per cent who work for a living to the ten per cent who sit at the top of the tree.”

— Colin Tudge, 2009

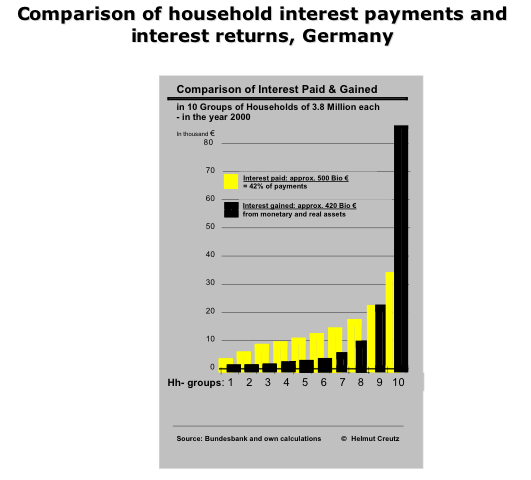

Interest payments are a mechanism for transferring wealth from the poor to the rich, both within nations and internationally. That and how this transfer occurs has been demonstrated in depth by the German researcher Helmut Creutz (2009), as can be seen in the chart showing a comparison of the interest payments and interest returns for German borrowers and lenders depending on their wealth (see below).

The wealthiest ten per cent of the population earn approximately twice as much in interest returns on their deposits at the bank as they pay in interest payments on their loans. For the bottom 80 per cent, this equation is reversed, with money paid out to pay interests on loans is double or more than double the amount of money earned in interest returns for deposits (Kennedy, 1995).

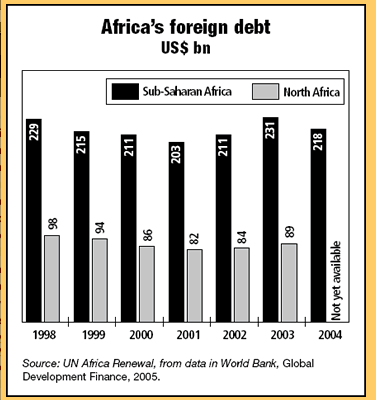

Above is a short video (3mins) by the OECD highlighting the global trend towards rising rather than falling inequality almost everywhere. This same principle also operates on the international level; the countries of the South have paid billions of US dollars in debt repayment to the rich nations and global financial institutions without, in many cases, repaying any of the capital borrowed at all.

All that we borrowed up to 1985 or 1986 was about $5 billion. So far we have paid back about $16 billion. Yet we’re being told that we still owe about $28 billion … because of foreign creditors’ interest rates. If you ask me what is the worst thing in the world, I will say it is compound interest.

— President Obasanjo of Nigeria.

The video above explains the mechanisms which drive the inbuilt transfer from rich to poor in some detail and ends with a proposal for a new design of ‘positive money’ that creates more equal, and thus healthier and more sustainable societies. You may also want to watch the two hour documentary 97% Owned — The Economic Truth Documentary.

We need an open and participatory dialogue on the re-design of our monetary systems, locally and globally.

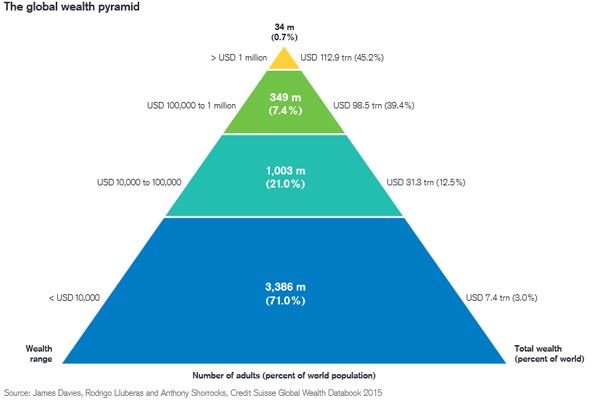

Credit Suisse has been publishing a Global Wealth Report for a number of years. The wealth pyramid (see graphic below) from the 2015 report shows that in that year there were 34 million people globally with a wealth equal or grater than 1 million dollars. The alarming fact is that while these people constitute only 0.7% of the global (adult) population, they own 45.2% of the world’s wealth, while the bottom 71% of the global (adult) population share only 3% of the world’s wealth among 3386 million people.

For further information on ‘What is wrong with the current monetary system’ have a look at this excellent article ‘What’s wrong with the current monetary system’ on the P2P Foundation wiki.

The dollar as a reserve currency transfers wealth from the rest of world to the USA

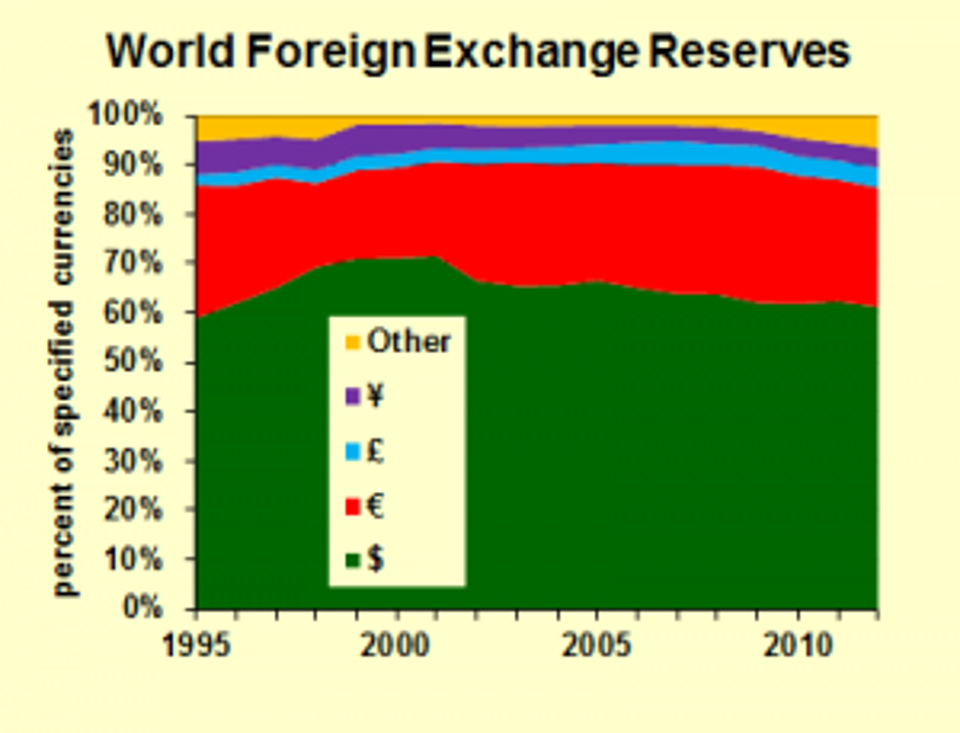

One final way in which money works today that has a substantial effect on the workings of the global political economy is the use of the US dollar as the international reserve currency. This follows the decision of the OPEC countries shortly after the end of the Second World War to accept only dollars for their oil. Today, the dollar is used for trade in many other commodities.

This acts as a huge subsidy to the US economy, since countries elsewhere in the world sell goods and services to the US, but instead of buying back from US companies, they keep the dollars so as to be able to trade among themselves — as well as to be able to protect their currencies from speculative attack. This effective transfer of wealth from the rest of the world to the US permits the US to be easily the world’s largest debtor nation, while driving the unprecedented widening of wealth disparity within the global community (Douthwaite, 1999).

It is unlikely that the dollar will remain the dominant international reserve currency for much longer and the shift towards other reserve currencies is likely to disrupt the global economic system severely. This coming crisis in the economic system could be an opportunity for a fundamental re-design of our monetary and economic system, rather than simply a shift from one dominant reserve currency to another. Many analysts predict that the dollar will loose this status within the next few years (more).

At the end of 2015 the IMF announced that the Chinese Yuan will join the list of SDR (Special Drawing Rights) reserve currencies in October 2016 (more), and China and Russia agreed on creating an exchange that allows them to trade more directly without the intermediary use of the US dollar. This further weakening of the position of the US dollar, its end as the world’s primary reserve currency and means of trading oil, is likely to drive a fundamental redesign of the world’s monetary system in the midst of further economic instability within the next few years.

NOTE: this is an excerpt from the Economic Design Dimension of Gaia Education’s online course in Design for Sustainability. The first version of this dimension was written in 2008 by my friend Jonathan Dawson, now Head of Economics of Transition at Schumacher College. In 2015–2016, I revised the Design for Sustainability course substantially and rewrote this dimension with more up-to-date information and the research that I had done for my book Designing Regenerative Cultures.

The next installment of the Economic Design Dimension started on March 19th, 2018 and runs for 8 weeks online. You can join the Design for Sustainability course at any point during the year.